Pick up the phone, choose the item you want to purchase, click on the checkout button, input your payment information, and then complete the payment. Whether you are creating an investment application or a mobile marketplace, it is important to incorporate a payment gateway into the mobile app. The simpler the payment process, the more sales you are likely to make. Here are some statistics to support this.

Fact #1: According to eMarketer, sales made through mobile commerce (m-commerce) will make up 43.4% of all retail sales in 2023, which is an increase from 41.8% in 2022. Additionally, in the US, m-commerce sales will represent 6.5% of total retail sales.

Fact #2: One out of every five customers leave their online purchases unfinished because the checkout process is too long and complicated, not including those who were just browsing and never intended to make a purchase.

These two facts have compelled retailers to create mobile applications that include payment gateways that operate efficiently and guarantee a fast, simple, and secure checkout process.

What is a Mobile Payment Gateway?

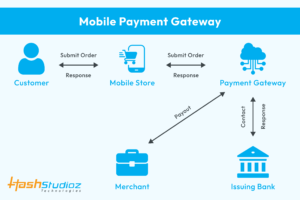

A mobile payment gateway is a service that allows for the authorization and processing of payments made through mobile apps. It ensures that transaction data is passed securely using security protocols and encryption. Essentially, the gateway acts as a middleman that helps facilitate financial transactions between customers and the merchant.

The whole process takes just a few seconds:

1. The customer selects and adds items to their online shopping cart, which is linked to the payment gateway for processing the payment.

2. It allows the merchant to enter payment information.

3. When the customer proceeds to the checkout stage of their purchase, the payment gateway system sends a request to the bank that issued the customer’s credit or debit card to process the payment transaction.

3. If there are no issues or problems, the bank will verify and approve the transaction.

Selecting a Mobile Payment Gateway: 5 Key Questions

1. What is your target audience?

when choosing a payment gateway for your mobile app, it is important to consider the countries where your users are located. Some payment gateways may only be available in certain countries, so you should make sure that the one you choose will work in the locations you are targeting. For example, Stripe is available in 25 countries, while PayPal is available in over 200 countries. Additionally, certain payment gateways may be more commonly used in specific countries, such as TSYS in Great Britain or PayPal in the USA. It is important to research and select a payment gateway that will best serve your target audience.

Important Note: If your business operates on a global scale, it is important to make sure that the payment gateway providers you work with are capable of processing payments in multiple currencies. This will allow you to accept payments from customers around the world in their preferred currency, making transactions more convenient and efficient for both parties.

2. What payment methods do your mobile app users prefer?

The various payment gateways support different payment methods, so it’s crucial to know what your customers prefer. Research shows that 40% of mobile app users feel more secure and comfortable using apps that provide more than one payment option. Therefore, offering multiple payment methods can enhance user confidence and satisfaction with your app.

3. How much does it cost?

when using payment gateways to process transactions, there are typically fees associated with each transaction. The standard fee for most payment gateways is approximately 2.9% of the transaction amount plus $0.30 per transaction. Examples of payment gateways that follow this pricing structure include Stripe, Amazon Pay, and AuthorizeNet. However, it is important to note that some payment gateways may have higher fees than this standard rate.

Additionally, apart from transaction fees, payment gateways may also require merchants to pay monthly expenses and setup fees.

4. Is the mobile payment gateway scalable and customizable?

If your business is expanding, it is important to plan for integrating a payment gateway into your mobile application. Before setting up recurring payments on your app, make sure that your chosen mobile payment gateway provider allows for sufficient customization options.

5. Does it have security certificates?

When dealing with sensitive data such as credit card information, selecting a secure mobile payment gateway is crucial. Studies have shown that over 80% of customers feel more secure when they see reputable online payment options.

When choosing a payment gateway, it is important also to consider implementing additional database software to further protect the payment data. This extra layer of security can help prevent unauthorized access to sensitive information.

Top Payment Gateways to Integrate With an App

1. PayPal

PayPal is a payment gateway provider that operates in over 200 countries, making it the largest of its kind. Some of its best features include the ability to split purchase transactions, access to reporting tools, easy invoicing, and simple payment procedures. Additionally, users have a variety of payment methods to choose from and are supported in maintaining PCI compliance.

Fee per transaction: 3.49% + $0.49

Availability in countries: 200+

2. Stripe

Stripe is a popular service that helps businesses accept payments online. It can handle transactions in over 135 different currencies and supports various payment methods. Together with PayPal, Stripe is one of the largest providers of payment gateways, which are systems that securely authorize and process online payments. Stripe processes more than 250 million API requests every day, showing how widely it is used by businesses to handle their online transactions.

Fee per transaction: 2.9% + $0.30

Availability in countries: 45+

Tips to Integrate Payments Into a Mobile App

Once you have become familiar with various payment gateways and have chosen the best one for your mobile app, the next step is to integrate it into your app. We have compiled 5 Software Development Kits that guide how to integrate payment gateways into mobile applications for developers working on both IOS and Android platforms.

How to Add Payment Gateway in the Android App

Integrating a payment gateway into an Android app involves choosing a provider, creating an account, and getting API credentials. Developers then incorporate the payment gateway’s software development kit (SDK) into their app, input the necessary credentials, and create interfaces for users to make payments. The app needs to be able to send payment requests, handle responses, and ensure security and compliance. After testing in a controlled environment, the app can go live, where it will be monitored and updated regularly to ensure payments are processed smoothly and securely.

How to Integrate Payment Gateway in iOS App

Integrating a payment gateway into an iOS app is similar to doing so for an Android app, but with specific tools and considerations for the iOS platform. This process involves choosing a payment provider, getting API credentials, and incorporating the provider’s iOS software development kit (SDK) into your Xcode project. You will need to create user interfaces for entering payment information, handle requests, and manage responses and errors. Security and compliance are important, including encryption and following industry standards like PCI DSS. After thorough testing in a sandbox environment, you can move to a live production environment, where you should continuously monitor transactions and stay up-to-date with legal and compliance requirements.

How much does a mobile payment gateway integration cost?

The price of adding a payment gateway to a mobile app depends on how complex the project is, how long it takes to integrate, and how much the developer charges for their services.

When you add a payment gateway to an app, you might need to include both basic and advanced features in your mobile application. This could involve setting up a database to store credit card information, creating systems for managing refunds or establishing connections between banks and your app’s users.

You have two main options to choose from: you can either hire a professional web developer or work with a web development company. While working with an agency may be more expensive, you will benefit from their coding expertise as well as project management, testing, and recommendations based on their past experiences with integrating payment gateways.

Furthermore, partnering with reliable mobile app development services can streamline the integration process and ensure that your app meets industry standards for security and compliance. These services can provide expertise in selecting and integrating payment gateways, as well as offer guidance on optimizing the checkout experience for your users.

![Detailed Guide to Yamunotri: The First Dham [Complete Travel Guide] 34 Detailed Guide to Yamunotri: The First Dham [Complete Travel Guide]](https://guest-post.org/wp-content/uploads/2024/07/Char-Dham-150x150.png)