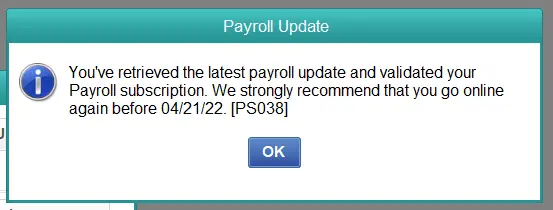

Dealing with Quickbooks Payroll Error PS038 can be a frustrating roadblock for many businesses. This pesky error can disrupt your payroll process and cause unnecessary stress. But fear not! In this blog post, we will guide you through the causes of Quickbooks Payroll Error PS038, provide step-by-step solutions to fix it, and offer tips on how to prevent similar errors in the future. Let’s dive in and get your payroll back on track!

Steps to Solve QuickBooks Payroll Error PS038

As mentioned below, QuickBooks Payroll Error PS038 occurs when users update their payroll to the latest tax table or send paychecks online. This error can cause significant disruption to your payroll process.

This QuickBooks error code can prevent you from updating your payroll to the latest tax table, resulting in inaccurate payroll calculations and potential legal ramifications.

It can delay employee payments if paychecks get stuck due to this error.

Payroll disruptions can affect other business operations, such as financial reporting and tax filing.

Below are possible solutions to this problem.

Solution 1: Update QuickBooks Desktop to Resolve Payroll Error PS038

- Close the QuickBooks application and the Company file.

- Select ‘Run as administrator’ from the right-click menu of the QuickBooks Desktop icon.

- Select ‘Update QuickBooks Desktop’ from the ‘Help’ menu.

- From the ‘Options’ tab, select the ‘Mark All’ button and then click on ‘Save.’

- You can reset the update by clicking the ‘Reset Update’ button on the ‘Update Now’ tab.

- You can get updates by clicking the ‘Get Updates’ button.

- Close the application after the update download is complete.

- To install the updates, open the application again and click the ‘Yes’ button.

- For the changes to take effect, restart your computer now.

Solution 2: Download the Latest Tax Table in QuickBooks Payroll

- Go to the ‘Employees’ menu.

- Select ‘Download Entire Update’ from the ‘Get Payroll Updates’ option.

- Now click on the ‘Download Latest Update’ button.

Solution 3: Fix Blocked Paychecks in Payroll

- Press ‘Find’ after selecting the ‘Edit’ option.

- Payroll Blocked Paychecks

- Go to the ‘Advanced’ tab.

- Click on the ‘Filter’ list and select ‘Detail Level’ from the ‘Choose Filter’ section.

- Choose ‘Summary Only’.

- Select the ‘Detail Level’ option from the ‘Choose Filter’ section.

- Click on ‘Choose Filter’.

- Select ‘Online Status’ from the ‘Filter’ list.

- Select ‘Online to Send’.

- Find out if the paycheck is pending or has not yet been sent by clicking ‘Find’.

Solution 4: Use Verify and Rebuild Data Tool to Fix QuickBooks Payroll Error PS038

- Launch QuickBooks on your desktop.

- Select the ‘File’ menu, ‘Utilities,’ and ‘Verify Data’.

- Close all open windows and background apps.

- Click OK if QuickBooks cannot detect any problems with your data.

- Go to the ‘File’ menu, ‘Utilities,’ and ‘Rebuild Data.’

- Click OK and then save to create a backup.

- Click on view results after the rebuild has been completed.

Step 5: Use Payroll Data and Company File Backup

- Select ‘File’, ‘Backup Company’, and ‘Create Local Backup’ from the menu.

- Go to Local Backup when the create backup page pops up.

- You will now see a Backup Options window under the Options tab.

- Navigate to Browse to select a location for the file.

- To confirm a location, tap OK.

- Choose the location where you would like to save the file by navigating to Browse.

- Choose a file hosting service, flash drive, or other removable media to save the backup once it has been saved in the local drive.

You can resolve QuickBooks Payroll Error PS038 by following these steps.

Conclusion

Quickbooks Payroll Error PS038 can be a frustrating issue for business owners and accountants alike. However, by understanding the causes of the error, following the steps to fix it, and taking preventative measures in the future, you can ensure smooth payroll processing with Quickbooks.

Remember to stay proactive in monitoring your payroll system for any potential errors and regularly update your software to avoid encountering similar issues in the future. By being vigilant and thorough in your approach to managing Quickbooks Payroll, you can minimize disruptions and keep your financial operations running smoothly.

![Detailed Guide to Yamunotri: The First Dham [Complete Travel Guide] 34 Detailed Guide to Yamunotri: The First Dham [Complete Travel Guide]](https://guest-post.org/wp-content/uploads/2024/07/Char-Dham-150x150.png)