Tech startups are known for their innovation, agility, and the ability to solve complex problems. However, one challenge many startups face is managing payroll efficiently. For young companies with limited resources, finding the right payroll solution is essential. This is where a free payroll check maker becomes a game-changer.

A free payroll check maker simplifies the payroll process, saves time, and ensures accuracy—all without adding financial strain to a startup’s budget. Here’s why tech startups should consider this tool for streamlined payroll management.

Understanding the Basics: What Is a Payroll Check Maker?

A payroll check maker is an online tool that allows businesses to create paychecks and pay stubs for their employees or contractors. These tools are user-friendly and often customizable, making them ideal for businesses that need flexibility. A free payroll check maker offers the same functionalities as paid versions, but without the added cost—a perfect solution for startups operating on tight budgets.

Why Payroll Efficiency Matters for Tech Startups

Payroll isn’t just about paying employees; it’s a critical part of maintaining trust, compliance, and operational efficiency. Here’s why payroll efficiency is particularly important for tech startups:

- Attracting Top Talent:

- Startups compete with established companies for skilled professionals. Offering timely and accurate payments builds trust with employees.

- Compliance with Laws:

- Payroll errors can result in penalties. A reliable tool ensures you meet federal, state, and local regulations.

- Focus on Core Activities:

- Streamlining payroll allows startups to concentrate on innovation and growth rather than administrative tasks.

- Managing Remote Teams:

- Many tech startups hire remote employees. A payroll check maker simplifies payments across various locations.

Benefits of Using a Free Payroll Check Maker

- Cost Savings:

- Startups often operate on lean budgets. A free payroll check maker eliminates subscription fees, allowing you to allocate resources elsewhere.

- User-Friendly Interface:

- Most tools are designed to be intuitive, requiring minimal training or experience.

- Accuracy and Compliance:

- Built-in features calculate taxes and deductions accurately, reducing the risk of errors.

- Professional Pay Stubs:

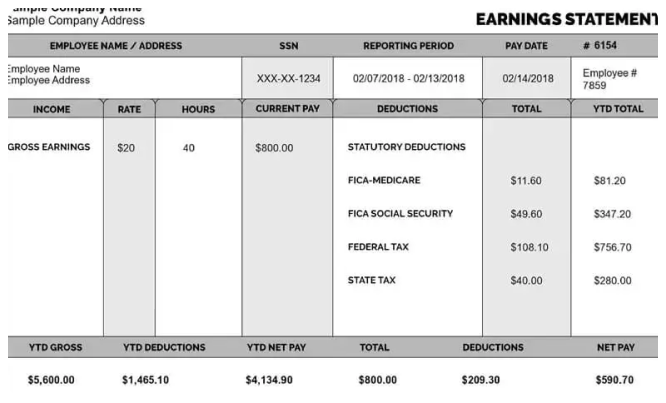

- A payroll check maker generates professional, detailed pay stubs that employees can use for financial documentation.

- Flexibility:

- Customizable templates ensure the tool meets the unique needs of your startup.

- Time Efficiency:

- Automating payroll tasks saves hours that can be redirected toward scaling your business.

Key Features to Look for in a Free Payroll Check Maker

When selecting a payroll check maker, prioritize the following features:

- Customizable Templates:

- Ensure the tool offers templates that can be tailored to your startup’s branding.

- Tax Calculations:

- Choose a tool that automates federal, state, and local tax calculations.

- Cloud Storage:

- Opt for a tool that saves payroll records securely for future reference.

- Digital Accessibility:

- The ability to generate and send paychecks electronically is essential for remote teams.

- Compatibility:

- Ensure the tool integrates with the accounting or project management software your startup uses.

How to Get Started with a Free Payroll Check Maker

1. Research and Select a Tool

Search for free payroll check makers that suit your business needs. Some popular options include:

- Wave: Offers free payroll tools with added features for growing businesses.

- Paycheck Free Generator: A simple solution for creating checks and pay stubs.

- Zintegrator: Ideal for small startups with remote teams.

2. Gather Employee Details

Before using a payroll check maker, ensure you have the following information:

- Employee names and addresses

- Payment rates (hourly or salary)

- Pay period details

- Tax withholding information

- Any additional deductions or benefits

3. Input Data

Log in to your selected payroll check maker and input the required information. Double-check for accuracy to prevent errors.

4. Review and Customize

Preview the generated paychecks and customize them as needed. Many tools allow you to add your company’s logo for a professional touch.

5. Distribute Paychecks

Once finalized, distribute paychecks to your team. Use digital delivery methods for remote employees to save time and resources.

Overcoming Common Challenges with Payroll Management

Tech startups may encounter several payroll challenges. Here’s how a free payroll check maker can help:

- Handling Contractor Payments:

- Startups often rely on contractors. A payroll check maker allows you to issue clear, accurate pay stubs for non-salaried workers.

- Navigating Tax Regulations:

- Different states have different tax laws. A good tool ensures compliance by automating calculations.

- Scaling Operations:

- As your team grows, manual payroll processes become cumbersome. A payroll check maker scales with your needs.

Real-Life Success Stories

Case Study: A Tech Startup’s Payroll Transformation

TechSpark, a five-person startup, struggled with manual payroll processes. Errors were common, leading to delayed payments and employee dissatisfaction. After switching to a free payroll check maker, the team noticed:

- A 50% reduction in payroll processing time

- Zero errors in paycheck calculations

- Improved employee morale due to timely and accurate payments

The free tool not only saved costs but also enhanced operational efficiency, allowing the founders to focus on product development.

Best Practices for Using a Free Payroll Check Maker

- Stay Organized:

- Maintain a record of all payroll data for tax filings and audits.

- Double-Check Inputs:

- Errors in input data can lead to incorrect paychecks. Always verify the information.

- Leverage Digital Tools:

- Combine your payroll check maker with other digital tools for seamless business management.

- Train Your Team:

- Ensure anyone handling payroll understands how to use the tool effectively.

- Monitor Updates:

- Regularly update your chosen tool to access new features and comply with changing regulations.

Conclusion

For tech startups, efficiency and cost savings are paramount. A free payroll check maker offers an ideal solution for streamlining payroll processes without adding financial burden. By automating payroll tasks, ensuring accuracy, and delivering professional paychecks, these tools allow startups to focus on growth and innovation.

Whether you’re managing a small team or planning to scale, adopting a free payroll check maker is a smart move. Take the time to explore your options, choose the right tool, and watch your payroll processes transform—all while keeping your startup on the path to success.

Related Articles

How to Access Kroger Paystubs Anytime, Anywhere

Complete Guide to Dollar General Paystubs(DG Paystub) and DGME Portal

How to Use the Walmart Paystub Portal Easily?

Employee Guide: Accessing ADP Pay Stubs with Ease

How To Get a Pay Stub From Ford?

How to Access, Download, and Interpret Dollar Tree Pay Stubs

Why is Intuit Paystub Perfect for Payroll Management? 5 Key Reasons