For small business owners, managing payroll can often feel overwhelming, especially when you’re balancing other responsibilities like customer service, marketing, and inventory management. One critical aspect of running a business is ensuring that your employees are paid accurately and on time. But it’s not just about handing over the paycheck – you need to provide your employees with something that shows how their earnings were calculated: a check stub.

A check stub maker is a tool that helps you generate accurate and professional pay stubs for your employees. This simple tool can save you time, reduce errors, and help you stay compliant with tax laws and labor regulations. In this blog, we’ll explore why small businesses need a free check stub maker, how it can benefit both employers and employees, and how to choose the right one for your business.

What is a Check Stub?

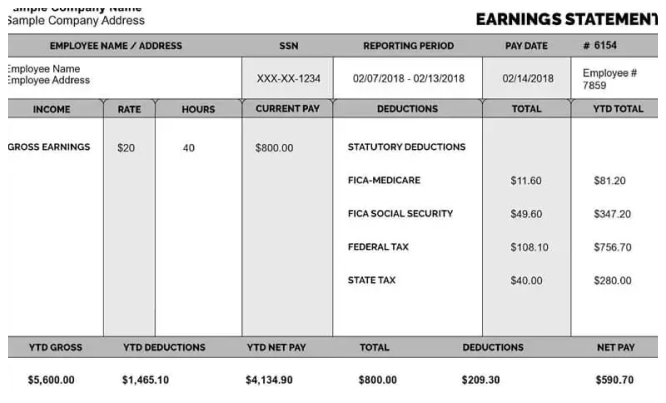

Before diving into the importance of using a check stub maker, let’s clarify what a check stub is. A check stub, also known as a pay stub, is a document that accompanies an employee’s paycheck. It provides a detailed breakdown of the employee’s wages for the pay period, including:

- Gross pay: The total amount earned before deductions.

- Deductions: This includes federal and state taxes, Social Security, Medicare, retirement contributions, and insurance premiums.

- Net pay: The amount the employee takes home after deductions.

A check stub is important because it provides clarity to the employee about how their paycheck was calculated and ensures that both the employer and employee are on the same page regarding wages and deductions.

Why Do Small Businesses Need a Check Stub Maker?

As a small business owner, you might wonder if investing in a check stub maker is really necessary. The truth is, using a check stub generator is not just a convenience—it’s a smart business decision. Here are some key reasons why small businesses need a check stub maker:

1. Ensure Accuracy and Reduce Errors

Calculating pay can be complex, especially if your employees have different hourly rates, work overtime, or have various deductions. Manually calculating these figures leaves room for error, which can lead to problems down the line—such as overpaying or underpaying employees.

A check stub maker automates the process of generating pay stubs, ensuring accuracy. With just a few clicks, you can enter the necessary details, and the tool will calculate the earnings and deductions correctly. This reduces the risk of mistakes and saves you valuable time.

2. Maintain Compliance with Labor Laws

In the U.S., labor laws vary by state, but in many states, employers are required to provide employees with a pay stub that details their earnings and deductions. Failing to do so can lead to legal issues or fines.

A check stub maker can help you comply with both state and federal regulations. These tools are typically updated to reflect the latest tax rates and labor laws, ensuring that your pay stubs meet legal requirements. This helps you avoid any legal complications while giving your employees the transparency they need.

3. Professional Appearance and Employee Trust

When you run a small business, the image you project to your employees matters. Providing well-designed, professional pay stubs can increase employee trust and satisfaction. A check stub maker helps you create clean, organized, and professional pay stubs that look official, giving your business a polished appearance.

Employees appreciate transparency when it comes to their pay. By offering detailed and accurate pay stubs, you show that you value their work and respect their financial well-being. This can boost morale and foster a positive work environment.

4. Easy Access and Record Keeping

A check stub maker is not just about creating pay stubs for the current pay period—it also helps you keep records for future reference. Many check stub generators allow you to store pay stubs electronically, making it easier to access and manage records.

This can be especially helpful for tax season, as you’ll have a clear record of all the pay stubs issued throughout the year. Having these records readily available can save time and reduce stress when you need to review past payroll or provide information to auditors.

Additionally, employees can often access their pay stubs online through an employer-provided portal. This offers convenience for both you and your employees, as they can access their pay stubs anytime and from anywhere.

5. Time and Cost Savings

Running payroll manually takes time, especially when you have to calculate taxes, deductions, and wages for multiple employees. A check stub maker simplifies this process, reducing the time it takes to generate pay stubs and helping you focus on other areas of your business.

For small business owners who may not have a dedicated HR or accounting department, using a check stub maker is a cost-effective solution. It eliminates the need for hiring additional staff or outsourcing payroll processing, allowing you to manage everything yourself.

6. Customization for Your Business Needs

Every business is different, and your payroll needs may not be the same as others. Many check stub makers allow you to customize your pay stubs with your business logo, employee details, and specific deductions. This helps you create a personalized and branded experience for your employees.

Customization options also allow you to include additional information, such as bonus pay, commissions, or reimbursements, depending on the nature of your business. This flexibility makes it easy to tailor the check stub to your unique requirements.

7. Simplifies Tax Filing

Filing taxes can be a complicated task, especially for small businesses. Having access to accurate check stubs makes it much easier to calculate and file taxes, whether you’re handling it yourself or working with an accountant.

A check stub maker automatically generates the necessary tax deductions, ensuring that you’re withholding the correct amount of federal and state taxes, as well as Social Security and Medicare contributions. This helps reduce the risk of errors when filing taxes and can save you from potential penalties.

How to Choose the Right Check Stub Maker for Your Small Business

Now that you understand the benefits of using a check stub maker, it’s time to choose the right one for your business. Here are a few things to consider when selecting a check stub generator:

1. Ease of Use

The best check stub makers are simple and easy to use, even if you have no prior experience with payroll or accounting. Look for tools with an intuitive interface that allows you to quickly input data and generate pay stubs without a steep learning curve.

2. Customization Features

Depending on your business needs, you may want a check stub maker that allows for customization. This includes adding your logo, adjusting tax deductions, and choosing the format of the pay stub. Choose a tool that offers flexibility so you can create pay stubs that reflect your business’s unique characteristics.

3. Accuracy and Compliance

Ensure the check stub maker is regularly updated to comply with the latest tax laws and labor regulations. This will ensure that your pay stubs meet legal requirements and are accurate in terms of deductions and tax rates.

4. Affordability

While there are many free and paid check stub makers available, it’s important to find a tool that fits within your budget. Some software providers offer a basic plan for smaller businesses or pay-per-use options, which can be cost-effective if you don’t need a full-service payroll solution.

5. Customer Support

Even with the best software, you might encounter issues or have questions along the way. Choose a check stub maker that offers solid customer support, whether through online chat, phone, or email, so you can get assistance when needed.

6. Security Features

Since pay stubs contain sensitive employee information, it’s important to select a check stub maker that prioritizes data security. Look for tools that encrypt employee information and offer secure online storage for pay stubs.

Conclusion

In conclusion, using a check stub maker is an essential tool for small businesses looking to streamline their payroll process. It helps ensure accuracy, maintains compliance with labor laws, and gives your employees the transparency they deserve. A check stub maker is a smart investment that saves time, reduces the risk of errors, and allows you to focus on growing your business. Whether you’re running a solo operation or managing a small team, a check stub maker will improve efficiency and professionalism, making payroll a hassle-free task.

By automating the generation of pay stubs, you can create a smoother payroll experience for both you and your employees, all while ensuring compliance and transparency. Take the step today and find a check stub maker that fits your needs – your business and your employees will thank you!

Related Articles

How to Access Your MyHTSpace Pay Stub?

How to Get a Check Stub From TruBridge?

How To Get Paystub From Zachary

Everything You Need to Know About Your Ford Paycheck Stubs

How to Obtain Hobby Lobby Pay Stubs: A Detailed Guide

The Importance of Tracking Your Family Dollar Paystub for Tax Season