Real estate agents are in a unique profession where income is primarily based on commissions, often fluctuating from month to month. With this variable earning structure, staying organized and tracking income can be a challenge. A paystub creator is an invaluable tool for agents to manage their finances effectively. It provides detailed records of commissions, deductions, and net pay in a professional and easy-to-understand format.

This blog will explore why every real estate agent should consider using a paystub creator for commission tracking and how it simplifies financial management.

1. The Importance of Commission Tracking for Real Estate Agents

For real estate agents, commissions are the primary source of income. Unlike salaried employees, agents need to be meticulous about tracking each sale and understanding how their earnings are calculated. Here’s why commission tracking is critical:

- Budgeting and Financial Planning: Irregular income makes it essential to have a clear picture of earnings to plan for expenses and savings.

- Tax Preparation: Detailed records simplify tax filing, especially for self-employed agents who handle their own taxes.

- Proof of Income: Accurate documentation is often required for loans, mortgages, or renting property.

- Professional Credibility: Well-maintained pay records add professionalism to your business.

A paystub creator makes it easy to generate detailed and accurate paystubs, helping agents stay on top of their earnings.

2. What is a Paystub Creator?

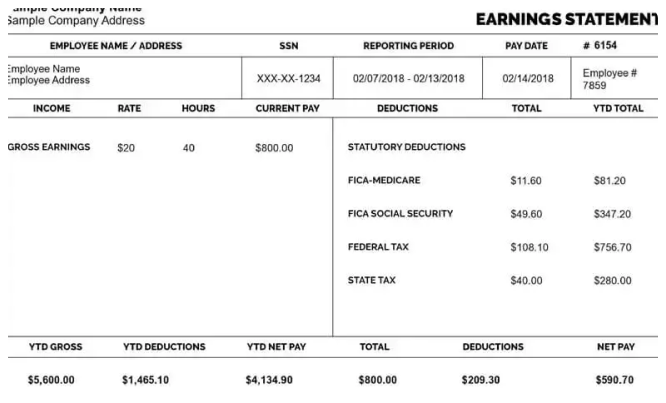

A paystub creator is a digital tool that generates professional paystubs based on the information you provide. It calculates gross earnings, deductions (such as taxes or expenses), and net pay, presenting the data in an easy-to-read format.

Real estate agents can use a paystub creator to:

- Document each commission payment.

- Include deductible expenses such as marketing costs or office fees.

- Create accurate records for financial or tax purposes.

3. Benefits of Using a Paystub Creator for Real Estate Agents

a. Simplifies Income Tracking

Real estate commissions can vary significantly based on the value of the property sold and the market conditions. A paystub creator consolidates all income sources into a single document, providing clarity and organization.

b. Ensures Accurate Tax Records

Self-employed agents are responsible for calculating and paying their taxes. A paystub creator helps:

- Track income and deductions.

- Maintain detailed records for quarterly tax payments.

- Avoid errors that could lead to penalties.

With a paystub creator, you’ll have all the information you need to file taxes accurately and efficiently.

c. Provides Proof of Income

Lenders, landlords, and financial institutions often require proof of income. For real estate agents, irregular earnings can be challenging to explain. Paystubs generated by a paystub creator serve as a professional and reliable proof of income.

d. Enhances Professionalism

Clients and business partners value professionalism. Providing detailed paystubs when required demonstrates that you take your financial management seriously.

e. Tracks Expenses and Deductions

Real estate agents often incur deductible expenses, such as:

- Marketing and advertising costs.

- Travel expenses for property visits.

- Licensing and membership fees.

A paystub creator allows you to document these deductions, ensuring you have a clear record for tax season.

4. How a Paystub Creator Works

Using a paystub creator is simple and requires minimal effort. Here’s a step-by-step guide for real estate agents:

Step 1: Input Your Details

Enter your personal information, including your name, business name, and address.

Step 2: Add Earnings

Input the commission amount earned from each sale or transaction.

Step 3: Include Deductions

Add deductions such as taxes, expenses, or retirement contributions.

Step 4: Review and Generate

The paystub creator calculates gross pay, deductions, and net pay automatically. Review the information for accuracy and generate the paystub.

Step 5: Save and Print

Download the paystub in digital format or print it for your records.

5. Real-Life Scenarios: How a Paystub Creator Helps Real Estate Agents

Scenario 1: Tax Filing

Sarah, a real estate agent, struggles to organize her commission earnings during tax season. By using a paystub creator, she generates monthly paystubs detailing her income and deductions. When tax season arrives, Sarah provides her accountant with these records, simplifying the filing process and reducing stress.

Scenario 2: Applying for a Mortgage

John, another agent, applies for a mortgage to buy his first home. The lender asks for proof of consistent income. John uses a paystub creator to generate professional paystubs from his commission earnings, helping him secure the loan.

6. Tips for Real Estate Agents Using a Paystub Creator

a. Update Regularly

Generate paystubs after each commission payment to maintain up-to-date records.

b. Customize for Deductions

Tailor your paystubs to include specific deductions, such as marketing or travel expenses.

c. Use Digital Storage

Store your paystubs digitally for easy access and organization.

d. Stay Informed

Keep track of tax laws and deductions relevant to real estate agents to ensure compliance.

7. Choosing the Right Paystub Creator

When selecting a paystub creator, look for the following features:

- Ease of Use: The tool should be intuitive and user-friendly.

- Customization Options: Ensure you can customize paystubs to include all necessary details.

- Affordability: Many paystub creators offer free or low-cost options.

- Compliance: Choose a tool that meets legal standards for pay documentation.

- Security: Verify that your financial data is protected with encryption.

Conclusion

For real estate agents, managing irregular income and tracking commissions can be overwhelming. A Free paystub creator simplifies the process by providing professional, accurate, and organized pay documentation.

From ensuring tax compliance to offering proof of income, a paystub creator is an essential tool for agents seeking to stay on top of their earnings. By integrating this tool into your workflow, you’ll gain greater control over your finances, reduce stress, and enhance your professional image.

If you’re ready to take charge of your commission tracking, start using a paystub creator today and experience the benefits firsthand.

Related Articles

How to Access Your MyHTSpace Pay Stub?

How to Get a Check Stub From TruBridge?

Everything You Need to Know About Your Ford Paycheck Stubs

How to Obtain Hobby Lobby Pay Stubs: A Detailed Guide

The Importance of Tracking Your Family Dollar Paystub for Tax Season

What is an eStub and How Does It Simplify Payroll Management?

How Does Verizon Paystub Help Ensure Payroll Accuracy and Transparency?

Understanding Your Pasadena Unified Paystub: A Quick Breakdown