For any business, keeping track of employee earnings is not just important—it’s essential. Whether you’re a small business owner or an HR manager in charge of payroll, ensuring that employees are paid correctly and on time is a crucial part of your operation. With so many factors to consider—hourly wages, salary, overtime, benefits, and taxes—it can be easy to lose track of things. This is where a paycheck creator can make a world of difference.

In the past, tracking employee earnings involved manual calculations, complicated spreadsheets, and a lot of room for error. But today, with the help of a paycheck creator, businesses can streamline the payroll process, track employee earnings accurately, and even automate many of the time-consuming tasks involved in payroll. If you’re looking for a solution to manage your payroll more effectively, here’s everything you need to know about using a paycheck creator to track employee earnings seamlessly.

What Is a Paycheck Creator?

A paycheck creator is an online tool or software that helps businesses generate accurate paychecks for their employees. Whether your employees are salaried or hourly, a paycheck creator calculates their earnings based on the information you provide, such as wages, hours worked, taxes, benefits, and deductions.

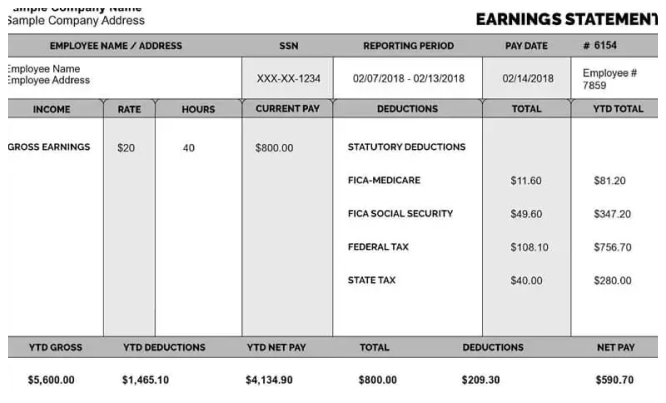

With just a few clicks, a paycheck creator can produce a professional-looking pay stub, showing all the details about how the employee’s earnings were calculated, including gross pay, tax withholdings, deductions, and the final net pay. These tools are designed to make payroll simpler and more efficient, reducing the risk of errors and saving businesses valuable time.

For small businesses especially, using a paycheck creator can eliminate the need for complex spreadsheets and manual calculations, making payroll a much smoother process.

Why Is Tracking Employee Earnings Important?

Before diving into the specifics of a paycheck creator, let’s briefly explore why tracking employee earnings is so important for any business. It’s not just about issuing paychecks on time—it’s about accuracy, compliance, and building trust with your employees.

- Legal Compliance

Businesses are required to follow strict labor laws, including tax withholding, overtime pay, and benefit deductions. If you fail to properly track employee earnings or make errors in deductions, you could face fines, penalties, or even lawsuits. Keeping accurate records ensures that your business remains compliant with local, state, and federal regulations. - Employee Satisfaction

Employees rely on their paychecks to meet their financial needs, so ensuring that they are paid correctly is essential for maintaining a positive work environment. If errors are made in their pay, it can lead to frustration and even trust issues. By accurately tracking earnings, businesses can keep employees happy and engaged. - Financial Planning and Reporting

For both the business and the employee, understanding earnings and deductions is important for financial planning. Businesses must track earnings for budgeting, forecasting, and taxes. Employees benefit from knowing their pay breakdown so they can make informed financial decisions. - Audit Preparedness

Keeping accurate records of employee earnings also helps your business stay prepared for audits. Whether it’s a tax audit or an internal review, having organized, accessible records ensures you’re ready to provide any necessary information quickly and efficiently.

How Does a Paycheck Creator Help Track Employee Earnings?

Now that we know why tracking employee earnings is so important, let’s talk about how a paycheck creator can help simplify this process for you and your business. Here are some key features and benefits:

1. Accurate Calculations Every Time

The most important benefit of using a paycheck creator is the accuracy it provides. Instead of relying on manual calculations, which can be prone to errors, a paycheck creator automatically computes all the essential details. From hourly wages to salary calculations, overtime, taxes, and deductions, a paycheck creator handles it all.

For example, if you have hourly employees, a paycheck creator will automatically calculate their gross pay by multiplying their hourly rate by the number of hours worked. It will also account for overtime pay based on the number of hours worked over 40 in a week. This saves you from worrying about making mistakes when calculating overtime or manually adding up hours worked.

2. Simplified Tax Withholding

Calculating tax withholdings can be complicated, especially if your employees live in different states or have various exemptions. The right paycheck creator will automatically calculate federal, state, and local tax withholdings based on the employee’s information, such as filing status, allowances, and any special deductions.

This ensures that you’re deducting the correct amount of taxes every time. Plus, with the ever-changing tax laws, using a paycheck creator helps keep your business compliant by using up-to-date tax rates and regulations.

3. Track Benefits and Deductions

Many businesses offer employee benefits such as health insurance, retirement plans, and other perks that require deductions from their paychecks. A paycheck creator helps you keep track of these deductions by automatically calculating them and deducting the correct amount from each paycheck.

Whether it’s a fixed contribution to a retirement plan or a health insurance premium that changes based on the plan selected, a paycheck creator will handle all of this for you. Additionally, the tool can track mandatory deductions such as wage garnishments, child support, or union dues, ensuring that the correct amounts are deducted.

4. Generate Detailed Pay Stubs

Once the paycheck creator has calculated the employee’s earnings, it can generate a detailed pay stub that includes all the necessary information. This pay stub will typically show the employee’s:

- Gross pay (before any deductions)

- Deductions for taxes, benefits, and other contributions

- Net pay (the final amount the employee takes home)

- Overtime and bonuses (if applicable)

- Year-to-date totals for earnings, taxes, and deductions

By providing employees with clear, detailed pay stubs, you can avoid confusion and maintain transparency. These pay stubs can be printed out for paper checks or sent electronically for employees who prefer digital records.

5. Keep Detailed Records for Future Reference

A paycheck creator not only generates pay stubs, but it also stores them in an organized digital format. This means you can easily track employee earnings and access records from previous pay periods whenever you need them. Whether it’s for tax purposes, audits, or resolving disputes, having these records stored electronically saves time and effort.

Additionally, paycheck creators often allow you to generate reports for tax filing, which makes year-end reporting much simpler. This ensures that your business remains prepared for tax season without scrambling to gather employee earnings data at the last minute.

6. Time-Saving Automation

One of the biggest advantages of using a paycheck creator is the time-saving automation. Payroll tasks can take hours if done manually, especially when you have multiple employees with varying pay rates, overtime, and benefits. A paycheck creator automates most of these tasks, reducing the time spent on payroll processing.

Once you input your employees’ information into the system, it will automatically calculate their pay, taxes, and deductions. This frees up your time to focus on other important areas of your business, rather than getting bogged down with payroll tasks.

7. Customizable and Flexible

Many paycheck creators offer customization options that allow you to tailor the paychecks to your business’s specific needs. You can adjust the layout of pay stubs, add your company’s logo, and include any other relevant information, such as additional bonuses or commissions. This flexibility ensures that your payroll system works for your unique business structure.

Conclusion

Tracking employee earnings doesn’t have to be a complicated, time-consuming task. With a free paycheck creator, you can streamline the entire payroll process, ensuring that your employees are paid correctly, taxes are withheld properly, and all deductions are accounted for.

By using a paycheck creator, businesses can ensure that they are compliant with tax laws, save time on payroll processing, and provide employees with clear, professional pay stubs. Whether you’re a small business owner or an HR professional, a paycheck creator is an invaluable tool to help you track employee earnings seamlessly and efficiently.

If you haven’t already, consider integrating a paycheck creator into your payroll system. It’s a simple, effective solution that makes managing payroll easier, more accurate, and more reliable.

Related Articles

How to Access Kroger Paystubs Anytime, Anywhere

Complete Guide to Dollar General Paystubs(DG Paystub) and DGME Portal

How to Use the Walmart Paystub Portal Easily?

Employee Guide: Accessing ADP Pay Stubs with Ease

How To Get a Pay Stub From Ford?

How to Access, Download, and Interpret Dollar Tree Pay Stubs

Why is Intuit Paystub Perfect for Payroll Management? 5 Key Reasons

Why Keeping Your Starbucks Pay Stub Is Important

Why Instacart Pay Stubs Matter for Your Financial Records?