In today’s fast-paced world, managing finances efficiently is crucial for both businesses and individuals. One essential tool that can help simplify this task is a check stub maker. A check stub maker allows you to create professional-looking pay stubs quickly and easily, whether for your employees or your records. But with so many options available, how do you choose the right one? In this blog, we’ll explore the top features to look for in a check stub maker, ensuring you get the best value for your needs.

1. User-Friendly Interface

One of the most important features of any software is how easy it is to use. A check stub maker should have a user-friendly interface that allows you to navigate through the program without confusion. Look for a tool that offers clear instructions, simple menus, and straightforward input fields. This will save you time and frustration, especially if you’re not tech-savvy.

Why It Matters

A user-friendly interface means you can focus on creating pay stubs instead of figuring out how the software works. This is particularly beneficial for small business owners who may have limited time and resources.

2. Customization Options

Every business is unique, and your pay stubs should reflect that. A good check stub maker will offer various customization options, allowing you to personalize your pay stubs with your business logo, colors, and specific payment details. This can enhance your brand image and provide a more professional look.

What to Look For

- Ability to add your logo

- Options for different fonts and colors

- Custom fields for bonuses, deductions, and taxes

3. Compliance with Local Laws

Payroll and tax laws can vary significantly from one state to another. A reliable check stub maker should ensure that your stubs comply with local regulations. This includes accurate calculations for federal and state taxes, as well as any other deductions.

Importance of Compliance

Using a compliant check stub maker helps avoid potential legal issues down the line. It ensures that you are accurately reporting income and taxes, which is crucial for both employees and employers.

4. Security Features

When dealing with financial documents, security is paramount. A check stub maker should have strong security measures in place to protect your sensitive information. Look for features like encryption, password protection, and secure cloud storage options.

Protecting Your Data

With the rise of cyber threats, safeguarding your financial data is essential. A secure check stub maker minimizes the risk of data breaches, ensuring that your information remains confidential.

5. Multiple Payment Methods

Different businesses have different payment structures. A versatile check stub maker should accommodate various payment methods, such as hourly wages, salaries, bonuses, and commissions. This flexibility is crucial for businesses with diverse employee compensation plans.

Flexibility in Payments

Whether you pay employees weekly, bi-weekly, or monthly, the right check stub maker should support all these payment frequencies without hassle. This ensures that all employees receive accurate pay stubs reflecting their earnings.

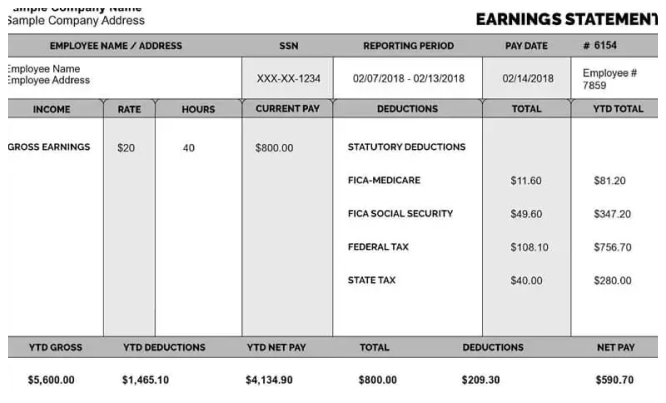

6. Automatic Calculations

Calculating taxes, deductions, and other payroll figures can be tedious and prone to error. A good check stub maker will include automatic calculation features that do the math for you. This reduces the likelihood of mistakes and saves you valuable time.

Features to Consider

- Automatic tax calculations for federal and state levels

- Deductions for benefits like health insurance or retirement contributions

- Total earnings and net pay calculations

7. Preview and Print Options

Before finalizing any pay stub, it’s essential to review it for accuracy. A reliable check stub maker should allow you to preview your stubs before printing or saving them. This ensures everything looks right and gives you a chance to make any necessary adjustments.

Quality Printing

Look for a check stub maker that offers high-quality printing options. This will ensure that your pay stubs look professional when handed out to employees or kept for your records.

8. Integration with Accounting Software

If you’re already using accounting software, a check stub maker that integrates seamlessly can save you time and effort. Look for options that allow you to export your pay stub data directly into your accounting system. This can help streamline your financial processes.

Benefits of Integration

Integration minimizes data entry errors and keeps your financial records up-to-date. This is especially helpful during tax season when accurate records are crucial.

9. Customer Support

Even the best software can sometimes run into issues or need clarification on features. Reliable customer support is an essential feature to consider when choosing a check stub maker. Look for companies that offer various support channels, such as live chat, email, and phone support.

Importance of Good Support

Having access to prompt and helpful customer service can save you time and frustration. If you encounter any issues or have questions, knowing there’s someone to help can make all the difference.

10. Affordable Pricing

Budget is always a consideration for businesses, especially small ones. Look for a check stub maker that offers transparent pricing with no hidden fees. Some tools may offer a one-time purchase option, while others operate on a subscription model. Determine what works best for your budget and needs.

Evaluating Cost vs. Features

While affordability is important, don’t compromise on essential features just to save money. Look for a check stub maker that provides a good balance of features and pricing.

11. Mobile Compatibility

In an increasingly mobile world, having the ability to create pay stubs on-the-go can be a significant advantage. A check stub maker that offers a mobile app or is mobile-friendly allows you to generate stubs anytime, anywhere.

Convenience of Mobile Access

This feature is especially useful for business owners who travel frequently or need to manage payroll while away from the office. Mobile compatibility adds flexibility to your financial management.

12. Positive User Reviews

Before making a decision, take the time to read user reviews and testimonials. This can give you valuable insights into how well a check stub maker performs in real-world situations. Look for feedback regarding ease of use, customer support, and overall satisfaction.

Learning from Others

Reviews can highlight potential issues and help you understand what to expect from the software. This can guide you in making an informed decision.

Conclusion

Choosing the right check stubs maker can significantly impact how you manage payroll and financial records. By considering the features mentioned above, you can find a tool that meets your specific needs and helps streamline your processes. Whether you’re a small business owner, an independent contractor, or someone managing personal finances, having a reliable check stub maker can save you time and reduce stress.

Take your time in evaluating different options, and don’t hesitate to try out free trials if they are available. With the right check stub maker, you’ll be able to create professional pay stubs effortlessly, ensuring accuracy and compliance while also enhancing your brand’s image. Make an informed decision and watch your financial management become a breeze!

Related Articles

How to Access Your MyHTSpace Pay Stub?

How to Get a Check Stub From TruBridge?

Everything You Need to Know About Your Ford Paycheck Stubs

How to Obtain Hobby Lobby Pay Stubs: A Detailed Guide

The Importance of Tracking Your Family Dollar Paystub for Tax Season

What is an eStub and How Does It Simplify Payroll Management?

How Does Verizon Paystub Help Ensure Payroll Accuracy and Transparency?

Understanding Your Pasadena Unified Paystub: A Quick Breakdown