Starting a business is both exciting and overwhelming. As a startup owner, you’re juggling multiple tasks, from marketing to product development, customer service, and more. Among the most important yet often neglected aspects of running a business is payroll. But managing payroll can be complex and time-consuming, especially if you’re working with a small team and limited resources.

This is where a free paycheck creator can help. Using a paycheck creator is an efficient way for startups to streamline payroll, ensure compliance with tax laws, and stay organized without breaking the bank. Let’s take a closer look at how a free paycheck creator can make a big difference for your startup and how you can make the most of it.

What is a Paycheck Creator?

A paycheck creator is a tool that helps businesses generate pay stubs or paycheck records for employees. It automates the process of calculating wages, deductions, and taxes. Instead of manually calculating each employee’s salary, overtime, tax withholdings, and deductions like healthcare, a paycheck creator does all the heavy lifting for you. These tools are typically online-based and available for free or at a low cost, making them ideal for startups and small businesses.

Key Features of a Free Paycheck Creator

- Automatic Calculations

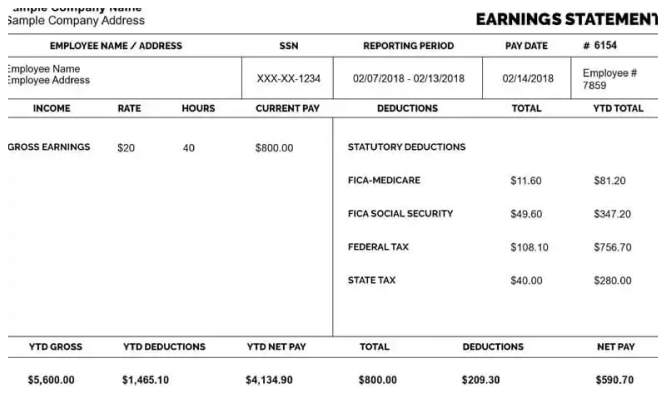

A free paycheck creator automatically calculates gross income, tax deductions, and any other necessary withholdings based on the information you input, such as salary, hours worked, and tax rates. This eliminates the need for complex manual calculations, reducing the risk of errors. - Customized Pay Stubs

You can customize pay stubs to include specific details like company name, employee information, pay period, and breakdowns of earnings and deductions. It ensures that all the essential details are presented, making it easier for both you and your employees to understand their payments. - Tax Compliance

Keeping up with changing tax laws can be tricky, especially for new businesses. A free paycheck creator can help you stay compliant by automatically factoring in federal and state taxes, Social Security, Medicare, and any other applicable deductions, reducing your risk of tax penalties. - Cost-Effective

Startups often operate with tight budgets. Investing in expensive payroll software can be a financial strain. Free paycheck creators provide a cost-effective solution to meet your payroll needs without spending extra on subscription fees or software. - Time-Saving

The tool can generate pay stubs quickly and efficiently. This is especially important for busy startup owners who are juggling multiple responsibilities. The time saved on manual payroll calculations can be redirected toward growing your business.

Benefits of Using a Free Paycheck Creator for Startups

For startups, using a free paycheck creator offers several advantages that can help streamline operations and improve financial management. Let’s explore some key benefits:

1. Efficiency and Accuracy

Managing payroll manually can take up a lot of time and is prone to human errors. Even a small mistake in calculating an employee’s wages or tax deductions can lead to financial discrepancies or legal issues. A free paycheck creator automates all these calculations, ensuring that your payroll is processed quickly and without mistakes. By eliminating errors, you reduce the risk of costly fines or unhappy employees.

2. Simplified Tax Filing

As a startup, tax filing can be a complex and stressful task. However, a paycheck creator helps you stay organized by tracking all the necessary deductions and filing requirements. Whether it’s federal taxes, state income tax, or Social Security contributions, these tools can automatically generate the correct amounts to ensure you don’t miss any deadlines.

3. Cost Savings

Startups often need to be mindful of their spending. The cost of hiring a professional payroll service or investing in paid payroll software can be out of reach for many new businesses. A free paycheck creator offers a budget-friendly solution, enabling you to manage your payroll without sacrificing quality or accuracy. Plus, you can avoid hiring extra staff to handle payroll, saving money in the long run.

4. Better Record-Keeping

A paycheck creator provides you with an easy way to keep detailed records of each employee’s pay. These records can be crucial for tax reporting, audits, and any potential disputes. Since all information is stored digitally, you won’t need to worry about keeping piles of paper pay stubs or tracking down old files. Digital records are secure, searchable, and easily accessible when needed.

5. Employee Transparency

Providing employees with clear and accurate pay stubs not only builds trust but also helps them understand their pay better. A paycheck creator generates detailed pay stubs that break down wages, hours worked, tax deductions, and any other benefits or withholdings. This transparency can lead to a more satisfied and motivated workforce, which is especially valuable for startups aiming to retain talent.

How to Choose the Right Free Paycheck Creator for Your Startup

While there are many free paycheck creators available, not all tools are created equal. When selecting a paycheck creator for your startup, consider these factors to ensure you choose the right one for your business:

1. Ease of Use

The tool should be easy to navigate, even for non-financial professionals. A complicated interface can cause unnecessary stress and delays in processing payroll. Look for a free paycheck creator with a simple, user-friendly design.

2. Customization Options

Ensure that the paycheck creator allows you to customize pay stubs according to your business’s needs. It should be flexible enough to accommodate different pay schedules, employee types (salaried or hourly), and deduction categories.

3. Tax Calculation Accuracy

Accurate tax calculations are essential for avoiding mistakes that could lead to fines or audits. Choose a paycheck creator that includes built-in tax calculations for federal and state requirements. The tool should update regularly to reflect any tax law changes.

4. Security Features

Payroll involves sensitive financial data, so the paycheck creator must be secure. Make sure the tool encrypts personal and financial information and complies with data protection regulations. Additionally, look for a tool that stores records safely and allows you to access them at any time.

5. Customer Support

Even with a free tool, it’s important to have access to reliable customer support in case something goes wrong. Look for a paycheck creator that offers a robust support system, whether through FAQs, chat, or email assistance.

How to Use a Free Paycheck Creator for Your Startup

Using a free paycheck creator is straightforward, even for those who don’t have a background in payroll management. Here’s a basic overview of how to use one:

- Sign Up for an Account

Most paycheck creators require you to create an account. This is usually free, and you may need to provide basic business information like your company name, address, and tax ID. - Input Employee Information

Enter details for each employee, including their full name, address, Social Security number, pay rate, and deductions. For hourly employees, input their work hours, and for salaried employees, input their annual salary. - Enter Payroll Details

Enter the relevant payroll details for the pay period, such as the start and end dates, overtime hours, bonuses, and commissions. The tool will automatically calculate the wages. - Generate Pay Stubs

After entering all the necessary information, the paycheck creator will generate pay stubs for each employee. Review the pay stubs for accuracy before distributing them to your team. - Download and Distribute Pay Stubs

Once the pay stubs are generated, you can download them and distribute them to your employees via email, print them out, or store them for future reference.

Final Thoughts

Managing payroll doesn’t have to be a daunting task for startups. With a free paycheck creator, you can simplify the process, save time, reduce errors, and stay compliant with tax laws—all without spending a fortune on payroll software. By automating your payroll tasks, you can focus on what matters—growing your business.

Make sure to select a tool that fits your needs and provides the necessary features to support your business as it scales. A good paycheck creator will save you valuable time, improve accuracy, and help ensure that your employees are paid correctly and on time.

Related Articles

How to Access Kroger Paystubs Anytime, Anywhere

Complete Guide to Dollar General Paystubs(DG Paystub) and DGME Portal

How to Use the Walmart Paystub Portal Easily?