Managing payroll is a crucial part of running a business, but it can often feel like a time-consuming and expensive task, especially for small business owners. From calculating wages and taxes to ensuring that deductions are accurate, payroll requires attention to detail and accuracy. One tool that has proven invaluable in simplifying this process is a check stubs maker.

A check stub maker is an online tool that helps generate professional and accurate pay stubs in minutes. It’s designed to save time, reduce errors, and streamline payroll processes for businesses of all sizes. In this blog, we’ll explore how using a check stub maker can save you time and money, why it’s essential for businesses, and how to choose the best one for your needs.

What Is a Check Stub?

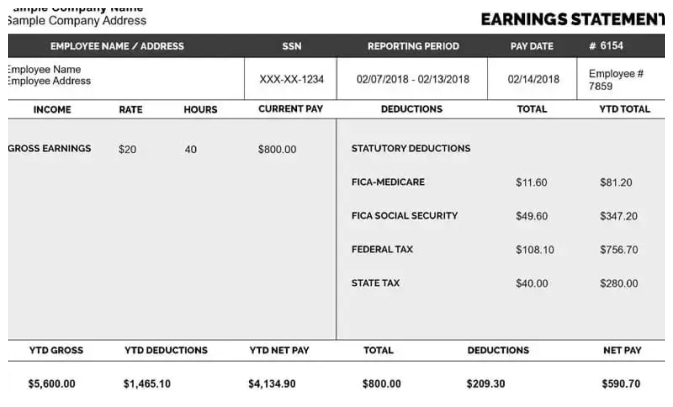

Before diving into the benefits of a check stub maker, let’s quickly define what a check stub is. A check stub, or pay stub, is a document that accompanies an employee’s paycheck. It provides detailed information about their earnings and deductions for a specific pay period, including:

- Gross Pay: The total earnings before deductions.

- Deductions: Taxes, Social Security, Medicare, insurance premiums, retirement contributions, etc.

- Net Pay: The take-home amount after deductions.

Check stubs also include other details such as hours worked, overtime, bonuses, and year-to-date totals. These documents are essential for transparency between employers and employees and are often required for tax filing, loan applications, or financial planning.

Why Do Businesses Need a Check Stub Maker?

A check stubs maker is an efficient way to automate and simplify payroll. It’s particularly beneficial for small businesses that don’t have a dedicated HR or payroll team. Here’s why businesses need one:

1. Save Time

Creating check stubs manually can be tedious, especially if you have multiple employees. A check stub maker automates the entire process, allowing you to generate accurate pay stubs in minutes. Instead of spending hours calculating wages and deductions, you can simply input employee details into the tool, and it does the rest for you.

2. Save Money

Hiring an accountant or outsourcing payroll can be costly for small businesses. A check stub maker offers a cost-effective alternative, enabling you to handle payroll yourself without the need for expensive software or additional staff. Many check stub makers offer affordable pay-as-you-go options, which are perfect for small-scale operations.

3. Ensure Accuracy

Payroll errors can lead to employee dissatisfaction and even legal issues. A check stub maker minimizes the risk of mistakes by automating calculations. These tools are designed to handle various deductions, including taxes, insurance, and retirement contributions, ensuring that all numbers are accurate.

4. Stay Compliant

Labor laws in many U.S. states require employers to provide employees with detailed pay stubs. Using a check stub maker ensures compliance by generating stubs that meet federal and state regulations. This helps you avoid potential fines or legal complications.

5. Improve Record-Keeping

Check stub makers often include features that allow you to save and organize pay stubs digitally. This makes it easier to access records during tax season, audits, or when employees request past stubs. Organized records also simplify financial planning and reporting for your business.

How a Check Stub Maker Saves Time

Time is one of the most valuable resources for any business owner. Here’s how a check stub maker helps you reclaim your time:

1. Quick Input Process

Most check stub makers require only basic information, such as employee details, hours worked, and hourly rates. Once entered, the tool calculates gross pay, deductions, and net pay automatically, eliminating the need for manual calculations.

2. Templates and Automation

Check stub makers come with pre-designed templates that meet legal standards. This means you don’t have to worry about formatting or including the necessary information—everything is pre-configured for you.

3. Batch Processing

If you have multiple employees, a check stub maker allows you to create pay stubs for all of them at once. This feature is especially useful for businesses with large teams or multiple pay cycles.

How a Check Stub Maker Saves Money

Small businesses are often looking for ways to cut costs without compromising quality. A check stub maker can help you do just that:

1. Eliminate Outsourcing Costs

Outsourcing payroll to an accountant or payroll service can be expensive. A check stub maker gives you the tools to handle payroll in-house, reducing overhead costs.

2. Avoid Penalties

Payroll errors, such as incorrect tax withholding, can lead to penalties from the IRS. A check stub maker ensures accurate calculations, helping you stay compliant and avoid fines.

3. Affordable Pricing

Many check stub makers offer flexible pricing options, such as pay-per-use or subscription plans. These are significantly cheaper than traditional payroll software or hiring additional staff.

Features to Look for in a Check Stubs Maker

Not all check stub makers are created equal. To get the most value for your money, look for a tool with the following features:

1. Ease of Use

A user-friendly interface ensures that you can generate pay stubs quickly and efficiently, even if you’re not tech-savvy.

2. Customization

The ability to customize your pay stubs with your business logo, unique deductions, or additional earnings like bonuses ensures a professional and personalized touch.

3. Compliance

Choose a regularly updated tool to reflect the latest federal and state tax laws. This ensures that your pay stubs meet legal requirements.

4. Accuracy

A reliable check stub maker should handle complex calculations accurately, including overtime pay, tax deductions, and benefits.

5. Digital Storage

Look for a tool that allows you to save and access past pay stubs digitally. This is useful for record-keeping and employee requests.

6. Secure Data Handling

Since payroll involves sensitive employee information, ensure that the check stub maker has strong security measures, such as data encryption.

Benefits for Employees

Using a check stub maker doesn’t just benefit employers—it also helps employees:

- Transparency: Employees can see exactly how their pay was calculated, including deductions and benefits.

- Financial Planning: Detailed pay stubs help employees budget and plan for expenses like taxes or loans.

- Easy Access: Many check stub makers allow employees to access their stubs digitally, providing convenience and flexibility.

Steps to Use a Check Stub Maker

Using a check stub maker is simple. Here’s how it works:

- Choose a Check Stub Maker Select a tool that fits your business needs. Look for features like customization, compliance, and affordability.

- Input Employee Details Enter basic information such as employee name, hours worked, hourly rate, and any additional earnings or deductions.

- Generate the Pay Stub The tool calculates gross pay, deductions, and net pay, then generates a professional pay stub.

- Download and Share Once the pay stub is generated, you can download it as a PDF and share it with your employees via email or print.

Why Efficiency Matters

In today’s fast-paced business world, efficiency is key to staying competitive. A check stub maker allows you to focus on growing your business instead of getting bogged down by payroll tasks. Streamlining the process can save time, cut costs, and provide your employees with accurate, professional pay stubs.

Conclusion

For small businesses, time and money are precious resources. A free check stubs maker is a powerful tool that helps you manage payroll efficiently, save costs, and stay compliant with labour laws. Whether you’re a small business owner or a manager looking for ways to simplify payroll, investing in a check stub maker is a smart decision.

By automating calculations, improving record-keeping, and creating professional pay stubs, a check stub maker ensures that payroll is no longer a hassle. Choose a tool that meets your needs, and you’ll be well on your way to saving time and money while keeping your employees happy and informed.

Related Articles

How to Access Your MyHTSpace Pay Stub?

How to Get a Check Stub From TruBridge?

How To Get Paystub From Zachary

Everything You Need to Know About Your Ford Paycheck Stubs

How to Obtain Hobby Lobby Pay Stubs: A Detailed Guide

The Importance of Tracking Your Family Dollar Paystub for Tax Season