Managing finances as a freelancer, contractor, or small business owner can be challenging. You’re in charge of everything—from handling your clients and completing work to ensuring your payments are accurate and on time. One of the most critical tasks is managing payroll, whether it’s for your own records or to provide clients with proof of payment. If you’re in need of a professional and efficient solution to handle check stubs, a free check stub maker can be your best friend.

A free check stub maker is a tool that allows you to create accurate, detailed pay stubs without any cost. Whether you’re a freelancer working with multiple clients, a small business owner, or an independent contractor, using a check stub maker can help you stay organized, avoid errors, and ensure your financial records are accurate.

In this article, we’ll explore the many ways a free check stub maker can help save you both time and money. By automating the process of creating pay stubs, you can streamline your payroll tasks and focus on the things that matter most—growing your business, improving your skills, and serving your clients.

What is a Check Stub Maker?

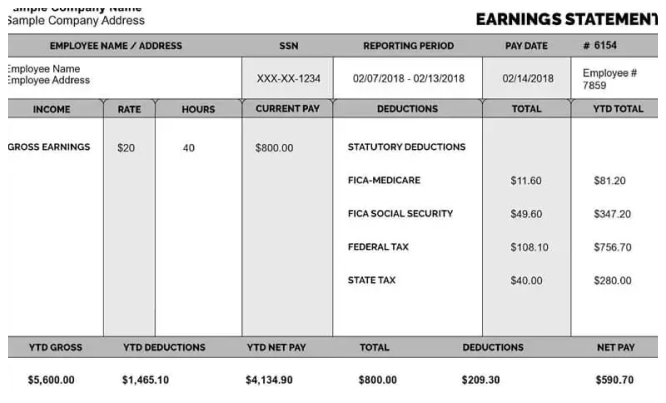

Before diving into the benefits, it’s essential to understand what a check stub maker is and how it works. A check stub maker is an online tool that allows users to create pay stubs for employees, contractors, or freelancers. A pay stub, also known as a paycheck stub, provides a detailed breakdown of an employee’s earnings for a particular pay period. It includes information such as:

- Gross income: The total amount earned before deductions (like taxes).

- Net income: The amount left after deductions, such as taxes and other contributions.

- Deductions: Various deductions like federal, state, and local taxes, as well as retirement contributions, health insurance, and other benefits.

- Hours worked: For hourly employees, the total hours worked during the pay period.

- Pay period dates: The specific dates for the pay period.

Using a check stub maker allows individuals or business owners to input these details and generate a professional-looking pay stub, ready for distribution to employees or clients.

Why Use a Free Check Stub Maker?

A free check stub maker can significantly benefit freelancers, contractors, and small businesses. Let’s explore how it saves both time and money.

1. No Need for Expensive Software

One of the most significant benefits of using a free check stub maker is that it eliminates the need for costly payroll software. Traditional payroll systems can be expensive, especially for small businesses or freelancers who don’t have many employees. By using a free tool, you can generate pay stubs without the hefty subscription fees associated with premium payroll services.

These tools are available to anyone, regardless of their business size, and they offer the same functionality as paid software. You don’t need to worry about ongoing payments for software licenses—just use the tool whenever you need to create pay stubs.

2. Quick and Easy to Use

Creating pay stubs manually can be time-consuming and error-prone, especially when you’re working with multiple clients or employees. A free check stubs maker streamlines the process and makes it much faster.

Typically, you’ll only need to input the following information to create a pay stub:

- Your name or business name

- The employee or client’s details (if applicable)

- Pay period and payment amount

- Deductions and taxes (optional, but helpful)

Most check stub makers offer simple, user-friendly interfaces that make the process quick and straightforward. In just a few minutes, you can generate a pay stub without needing any specialized knowledge or accounting skills.

3. Accurate Tax Calculations

For freelancers, contractors, and small business owners, managing taxes can be a complex task. Since taxes aren’t automatically deducted from payments like they are with traditional employment, it’s crucial to calculate the right amounts. A free check stub maker can help by automatically calculating tax deductions for you.

Most of these tools are updated to reflect current federal, state, and local tax rates. You can input your earnings and allow the check stub maker to calculate taxes and deductions for you. This eliminates the risk of overpaying or underpaying taxes, which could result in fines or missed payments to tax authorities.

Additionally, having accurate tax information on your pay stub makes tax time much easier. You’ll have detailed records to submit when filing your taxes, reducing the time spent sorting through financial documents.

4. Professional, Well-Formatted Pay Stubs

Even if you’re a freelancer or small business owner, presenting professional documentation is important for building trust with your clients and employees. A free check stub maker generates clean, easy-to-read pay stubs that look professional and organized. These pay stubs can be sent to clients or employees as proof of payment or earnings.

Having a professional-looking pay stub also helps in situations where you need to show proof of income, such as when applying for loans or leases. A well-formatted pay stub provides a clear breakdown of your earnings and deductions, which helps potential lenders or landlords trust your financial stability.

5. Easy Record Keeping and Organization

Keeping accurate records of your payments and earnings is essential for freelancers and small business owners. Whether it’s for taxes, business budgeting, or potential audits, organized records are invaluable.

A free check stub maker allows you to download, print, and save pay stubs for future reference. The pay stubs are typically available in PDF format, which is easy to save and organize on your computer or cloud storage. By using these digital tools, you can create and store pay stubs for multiple pay periods in one place, making it simple to track your earnings over time.

Organized records also make it easier to reconcile your payments at the end of the month or year, ensuring everything matches up for tax purposes.

6. Customizable to Your Needs

While free tools are often simple, many free check stub makers allow for some customization to meet your specific needs. You can usually customize the pay stub template with your business name, logo, contact information, and employee details. Some tools also allow you to adjust deductions, add bonuses or commissions, and change the pay period to fit your unique schedule.

This flexibility ensures that your pay stubs accurately reflect your specific situation, whether you’re a contractor working for one client or a small business owner paying multiple employees.

7. No Need for a Payroll Department

For small businesses, hiring a payroll team or outsourcing payroll services can be costly and unnecessary. If you have just a few employees or are a solo freelancer, managing payroll yourself is often more efficient and affordable.

A free check stub maker eliminates the need for a dedicated payroll department. You can handle your own pay stubs with minimal effort, saving your business money on payroll services or salaries for additional employees. This is especially beneficial for freelancers and independent contractors who only need to create pay stubs for themselves.

How to Use a Free Check Stub Maker

Using a free check stub maker is simple. Here’s a step-by-step guide on how to create a pay stub using one of these tools:

Step 1: Choose a Check Stub Maker

First, find a free check stub maker online. There are several options available with easy-to-use interfaces. Choose one that fits your needs and start creating your pay stub.

Step 2: Enter the Required Information

Once you’ve selected your tool, enter the necessary details. This will include your name, business name (if applicable), and the client or employee’s details. You’ll also need to input the pay period, payment amount, and any deductions or taxes that apply.

Step 3: Review Your Information

Before generating the pay stub, review all the information you’ve entered to ensure it’s accurate. This includes confirming the pay period, hours worked (if applicable), and deduction amounts.

Step 4: Generate the Pay Stub

Click the button to generate your pay stub. Most check stub makers will automatically calculate taxes and deductions for you, so all you need to do is confirm the information.

Step 5: Download and Save

Once your pay stub is generated, you can download it in PDF format. Save the file on your computer or cloud storage for future reference. You can also print a copy if needed.

Step 6: Distribute the Pay Stub

You can now send the pay stub to your clients, and employees, or keep it for your records.

Conclusion

In today’s fast-paced world, freelancers, contractors, and small business owners need efficient solutions for managing their finances. A free check stub maker is a powerful tool that can save you both time and money by streamlining the process of generating pay stubs. With a few simple steps, you can create professional, accurate pay stubs, keep track of your earnings, and handle taxes without the need for expensive software or complicated systems.

Whether you’re a freelancer working with multiple clients, a small business owner managing employees, or an independent contractor handling your own payroll, using a free check stub maker can simplify your financial processes and help you focus on growing your business. By eliminating costly payroll services, reducing errors, and providing a professional touch to your financial documentation, a check stub maker empowers you to take control of your income with ease.

Related Articles

How to Access Your MyHTSpace Pay Stub?

How to Get a Check Stub From TruBridge?

How To Get Paystub From Zachary

Everything You Need to Know About Your Ford Paycheck Stubs

How to Obtain Hobby Lobby Pay Stubs: A Detailed Guide

The Importance of Tracking Your Family Dollar Paystub for Tax Season