In today’s fast-paced world, managing finances efficiently has become more critical than ever. Whether you’re an employee wanting to keep track of your earnings or a small business owner needing accurate payroll documentation, a paystub creator offers an easy, reliable solution for tracking deductions and taxes. This digital tool simplifies the process, giving you clarity about your income, deductions, and overall financial health.

In this blog, we’ll explore what a paystub creator is, why it’s essential, and how it can help you stay on top of your financial game.

What Is a Paystub Creator?

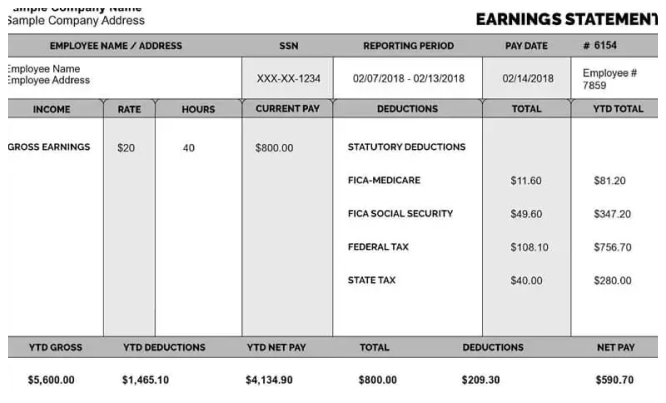

A paystub creator is a digital tool that generates paystubs or paycheck statements. These documents summarize an individual’s earnings, deductions, and net pay for a specific period. Traditionally, paystubs were part of printed paychecks, but now they’re often issued electronically, and creating them has become easier thanks to paystub generators.

Paystub creators are used by:

- Employees to verify income and tax deductions.

- Freelancers to provide proof of earnings.

- Small business owners to streamline payroll processes.

These tools can be customized to fit the unique needs of any business or individual, ensuring compliance with tax regulations and providing accurate documentation.

Why Is Tracking Deductions and Taxes Important?

Understanding deductions and taxes is vital for everyone, from employees to business owners. Here’s why:

- Transparency in Income

Paystubs break down gross income, taxes, insurance premiums, and other deductions, showing how your paycheck is distributed. - Financial Planning

Tracking deductions and net pay helps in budgeting and planning for expenses. - Tax Filing

Come tax season, having accurate paystubs simplifies filing and ensures you’re paying the correct amount. - Proof of Income

Whether you’re applying for a loan, renting a property, or making a big purchase, paystubs serve as essential proof of earnings.

Key Features of a Paystub Creator

A good paystub creator makes tracking deductions and taxes simple. Here are some of the features to look for:

1. Customization Options

Paystub creators allow you to input your company name, address, employee details, and payment schedule. This ensures the paystub meets specific needs.

2. Accurate Tax Calculations

Many tools are programmed with up-to-date tax rates, ensuring deductions like federal, state, and local taxes are calculated accurately.

3. Ease of Use

Modern paystub creators are user-friendly, allowing anyone to create a paystub in just a few steps.

4. Multiple Formats

Paystubs can be generated in printable formats like PDF, making them easy to store and share.

5. Affordable or Free Options

There are many free or low-cost paystub creators available, making them accessible to individuals and small businesses alike.

Benefits of Using a Paystub Creator

1. Simplifies Payroll Management

For small business owners, manually preparing paystubs can be time-consuming. A paystub creator automates this process, saving time and reducing errors.

2. Enhances Professionalism

Providing employees or clients with detailed, professional-looking paystubs enhances trust and credibility.

3. Ensures Compliance

A paystub creator ensures you’re meeting legal requirements for tax reporting and payroll documentation.

4. Accessible Anywhere

Most paystub creators are online tools, meaning you can access them anytime, anywhere, whether you’re at home or in the office.

5. Reduces Errors

Manual calculations can lead to mistakes in deductions and tax withholdings. A paystub creator minimizes these errors by automating the process.

How to Use a Paystub Creator

Using a paystub creator is straightforward. Here’s a step-by-step guide:

- Choose a Reliable Paystub Creator

Look for an online tool with good reviews and features that suit your needs. - Input Employee Details

Add information like name, address, job title, and payment frequency. - Enter Income Information

Input the gross income, overtime hours (if any), and any bonuses. - Specify Deductions

Include federal and state tax withholdings, social security, health insurance, and other deductions. - Generate the Paystub

Once all details are entered, the paystub creator will calculate the deductions and net pay. Download or print the generated paystub for your records.

Who Can Benefit from a Paystub Creator?

1. Employees

Employees can use paystub creators to track their income and deductions, ensuring their employers are withholding the correct taxes and other amounts.

2. Freelancers and Gig Workers

Many freelancers don’t receive traditional paystubs. A paystub creator allows them to create professional documents for proof of income.

3. Small Business Owners

For small businesses, a paystub creator reduces the hassle of payroll management, ensuring accuracy and compliance.

Common Deductions and Taxes on Paystubs

A paystub creator typically accounts for the following deductions:

- Federal Income Tax

This is the tax withheld based on your earnings and filing status. - State Income Tax

Not all states require income tax, but for those that do, this deduction is included. - Social Security and Medicare Taxes

Also known as FICA taxes, these fund Social Security and Medicare programs. - Health Insurance Premiums

If you have employer-sponsored insurance, the premiums are deducted from your paycheck. - Retirement Contributions

Contributions to 401(k) or similar plans may also be deducted. - Other Deductions

These can include union dues, garnishments, or additional insurance policies.

Tips for Choosing the Right Paystub Creator

When selecting a paystub creator, consider these tips:

- Look for Tax Compliance

Ensure the tool is updated with current tax rates and regulations. - Ease of Use

Choose a platform with a simple, intuitive interface. - Customization Options

The ability to customize details is essential for creating accurate and professional paystubs. - Secure and Reliable

The paystub creator should protect sensitive data and provide reliable service. - Cost-Effectiveness

Many tools are free or have affordable pricing plans, so find one that fits your budget.

Conclusion

A free paystub creator is a game-changer for anyone looking to manage their finances, whether it’s tracking deductions, understanding taxes, or creating proof of income. It simplifies the process, saves time, and ensures accuracy, making it an invaluable tool for employees, freelancers, and small business owners alike.

By using a reliable paystub creator, you can gain better control of your financial records, stay compliant with tax regulations, and confidently handle everything from budgeting to tax filing.

Start exploring the right paystub creator today and take the first step toward financial clarity and peace of mind!

Related Articles

How to Access Your MyHTSpace Pay Stub?

How to Get a Check Stub From TruBridge?

How To Get Paystub From Zachary

Everything You Need to Know About Your Ford Paycheck Stubs

How to Obtain Hobby Lobby Pay Stubs: A Detailed Guide

The Importance of Tracking Your Family Dollar Paystub for Tax Season