Managing deductions and understanding exactly where your money goes can be complicated. Whether you’re a freelancer, small business owner, or a part-time employee, having a clear view of your earnings and deductions is essential. Using a check stub maker is a smart way to stay organized and on top of your finances. It helps you understand the breakdown of each paycheck, from gross income to the net amount you receive after deductions. This blog will explore how to use a check stub maker to calculate deductions accurately, making it easier to manage your income and budget.

What is a Check Stub Maker?

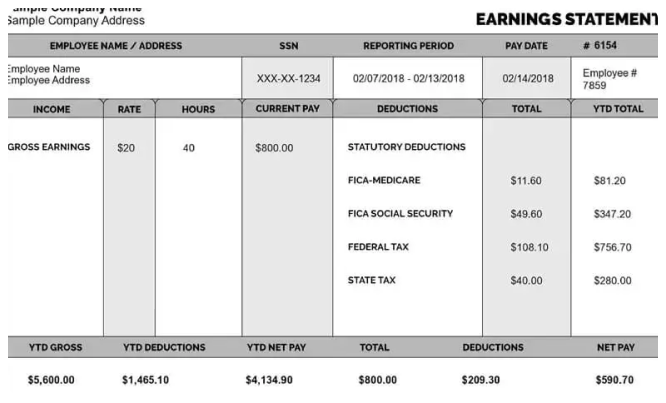

A check stub maker is an online tool that lets you create professional-looking pay stubs that detail your earnings and deductions. While traditionally used by employers, these tools are becoming popular for personal use as well. If you’re self-employed, freelancing, or juggling multiple income sources, a check stub maker can help you track your finances and calculate deductions.

These tools are generally user-friendly and offer options to customize pay stubs with specific details, like employer information, hours worked, and any necessary deductions. For those who need quick and accurate calculations, a check stub maker simplifies the process, giving you easy access to well-organized records of your earnings.

Why Are Deductions Important?

Deductions are amounts that are subtracted from your gross income, covering various payments such as taxes, insurance premiums, and retirement contributions. By understanding your deductions, you can make better financial decisions and avoid surprises at tax time. Here’s a breakdown of some common types of deductions:

- Federal and State Taxes: Income taxes are often the largest deductions from a paycheck, going toward federal and, in some cases, state and local taxes.

- Social Security and Medicare: These deductions fund essential programs and are typically required by law.

- Health Insurance: Some employers deduct health insurance premiums directly from employee paychecks.

- Retirement Contributions: Contributions to a 401(k) or similar retirement plan may be deducted from your earnings if you’ve opted into the plan.

Each of these deductions reduces your take-home pay, which is why it’s important to calculate them correctly. Using a check stub maker to calculate deductions can help you understand how much you’re paying toward these categories and plan your budget accordingly.

Who Can Benefit from Using a Check Stub Maker?

A check stub maker isn’t just for business owners or employers; it’s also a useful tool for individuals who need clear, detailed records of their income and deductions. Here are a few groups that might benefit:

- Freelancers and Self-Employed Individuals: Tracking income and expenses can be challenging, especially when multiple clients are involved. A check stub maker can help create structured income records.

- Part-time or Gig Workers: Those working part-time jobs or in the gig economy can use a check stub maker to create pay stubs for proof of income and to calculate deductions.

- People with Side Jobs: If you have a main job and a side gig, creating pay stubs helps you stay organized and monitor your additional income and deductions.

- Small Business Owners: If you run a small business and don’t have a dedicated payroll system, a check stub maker can simplify income tracking for yourself and any employees.

Step-by-Step Guide: Using a Check Stub Maker to Calculate Deductions

Using a check stub maker is generally a straightforward process, and with a few key details, you can accurately calculate your deductions. Here’s a step-by-step guide to help you get started:

Step 1: Choose a Reliable Check Stub Maker

There are many check stub makers available online, so take some time to research and choose one that offers the features you need. Look for tools that allow customization, perform automatic calculations, and provide secure data handling. Some check stub makers are free, while others charge a small fee per pay stub. Pick one that fits your needs and budget.

Step 2: Enter Personal and Employer Information

Once you’ve selected a check stub maker, start by entering your personal details and employer information. This generally includes:

- Your name and address

- Your employer’s name and address (if applicable)

- The pay period for the check stub (weekly, bi-weekly, monthly, etc.)

Entering this information accurately is essential, especially if you plan to use these stubs for official purposes like loan applications or tax filing.

Step 3: Enter Income Details

Next, input your income details, which typically include:

- Hourly Rate or Salary: Enter your hourly wage or annual salary. If you’re working multiple jobs or projects, make sure to enter the income details for each source.

- Hours Worked: If you’re paid hourly, enter the total hours worked for the pay period. The check stub maker will then calculate your gross income based on this data.

This information will form the basis of your gross earnings before any deductions.

Step 4: Specify Deductions

This step is where you can add any deductions to your pay stub. A quality check stub maker will allow you to input different types of deductions, including:

- Federal Income Tax: Input the correct tax percentage or dollar amount based on your tax bracket.

- State and Local Taxes: Add these deductions if applicable to your location.

- Social Security and Medicare: These are mandatory deductions under the Federal Insurance Contributions Act (FICA).

- Health Insurance and Retirement: If you contribute to a health insurance plan or a retirement fund, enter these amounts.

Once you’ve input all relevant deductions, the check stub maker will calculate them automatically and subtract them from your gross income, showing you the net amount you’ll receive.

Step 5: Review and Customize (Optional)

Before finalizing your check stub, take a moment to review the information you’ve entered. Many check stub makers allow you to customize the layout, fonts and even add additional notes if needed. Ensure that all information is accurate, as errors could affect your calculations and financial records.

Step 6: Generate and Save the Pay Stub

After reviewing the information, go ahead and generate your pay stub. Many check stub makers provide options to download the document as a PDF, which you can save or print for your records. Keeping organized records of each pay stub will make it easier to track income and deductions over time.

Benefits of Calculating Deductions with a Check Stub Maker

Using a check stub maker has several advantages when it comes to calculating deductions and managing income:

- Accuracy: Check stub makers perform automatic calculations, reducing the chances of error in your deductions.

- Time-Saving: Instead of calculating deductions manually, the tool does the work for you, saving time and effort.

- Clarity: Seeing deductions broken down clearly on each pay stub helps you understand where your money is going, making it easier to budget.

- Professional Documentation: For self-employed individuals or freelancers, having professional-looking pay stubs can be useful when applying for loans or financial assistance, as they provide credible proof of income.

Conclusion

A free check stub maker is a valuable tool for anyone looking to calculate deductions and keep accurate records of their income. Whether you’re managing your finances or handling payroll for others, these tools simplify the process of calculating federal taxes, social security, health insurance, and more. By generating organized, detailed pay stubs, you can stay on top of your income, track deductions, and make budgeting easier.

With the simple steps outlined here, you can start using a check stub maker to better understand your finances, avoid surprises at tax time, and take control of your budget. Try out a reliable check stub maker today, and see how it can streamline your financial record-keeping and make managing deductions easier.

Related Articles

How to Access Your MyHTSpace Pay Stub?

How to Get a Check Stub From TruBridge?

How To Get Paystub From Zachary