Managing payroll is a critical task for any business, large or small. Whether you’re a freelancer, a startup owner, or a small business operator, paying your employees or contractors correctly and on time is essential to running your business smoothly. Creating professional payroll checks can seem like a daunting task, especially when you don’t have the budget for expensive payroll software. But here’s the good news: you can create professional payroll checks for free!

In this blog, we will explore how to make payroll checks using a free payroll check maker, which can help you save time, and money, and reduce the risk of errors in your payroll process. Let’s dive into the benefits, features, and step-by-step instructions for creating payroll checks that look professional, are easy to use, and ensure your employees are paid accurately.

What Is a Free Payroll Check Maker?

A free payroll check maker is an online tool designed to help business owners generate payroll checks without paying for expensive payroll software. These tools allow you to enter the necessary employee details (such as their name, hours worked, and pay rate) and automatically generate a pay stub or payroll check. The best part? It’s free and easy to use, even if you don’t have a background in accounting.

These tools are perfect for small business owners, freelancers, and startups who need to create paychecks for their employees but don’t want to invest in complex payroll software. Most free payroll check makers offer user-friendly interfaces, which means that even people without much financial experience can use them with ease.

Why Use a Free Payroll Check Maker?

There are many reasons why a free payroll check maker is an excellent choice for creating professional payroll checks. Below are the main benefits:

1. Cost-Effective

One of the biggest advantages of using a free payroll check maker is that it eliminates the cost of expensive payroll software. Many businesses—especially small businesses and freelancers—are looking for ways to cut costs, and a free payroll check maker provides an easy and affordable solution.

2. Easy to Use

These tools are designed to be user-friendly. You don’t need to be an accountant or payroll expert to use them. The interface is typically simple and intuitive, with step-by-step guidance to help you input the right data and generate accurate paychecks in just a few clicks.

3. Accurate Paychecks

A free payroll check maker ensures that your payroll checks are accurate. These tools often include automatic tax calculations, benefits deductions, and more, helping you avoid the mistakes that come with manual calculations.

4. Saves Time

With a free payroll check maker, you can create paychecks quickly. Instead of spending hours calculating payroll by hand or using outdated methods, the tool does the hard work for you in a matter of minutes, allowing you to focus on other aspects of your business.

5. Customization Options

A free payroll check maker also allows you to customize your paychecks with your business logo, employee details, and other relevant information. This gives your paychecks a more professional and polished look, which can help build trust with your employees.

6. Compliance with Tax Laws

Payroll taxes can be complicated, but most free payroll check makers include tax calculations that are updated regularly. These tools ensure that your paychecks comply with the latest federal and state tax laws, which reduces the risk of errors and fines.

How to Use a Free Payroll Check Maker

Now that we know the benefits of using a free payroll check maker, let’s go through the steps on how to use these tools to create professional payroll checks.

Step 1: Choose the Right Free Payroll Check Maker

The first step is to choose a free payroll check maker that fits your needs. There are several options available online, so look for a tool that offers the features you require. Some popular options include:

- Wave Payroll (offers a free version for freelancers)

- PayStubCreator (easy-to-use pay stub generator)

- Online Pay Stub Generator (quick and simple)

- QuickBooks Payroll (has a free version for simple payroll tasks)

Check the features of each tool to ensure they support your payroll requirements. Once you’ve found the right one, sign up or start using the free version.

Step 2: Gather the Necessary Information

Before you can create a payroll check, you’ll need to gather some essential information. This includes:

- Employee Name: The full name of the person you are paying.

- Address: Employee’s address (may be required for tax purposes).

- Payment Date: The date the payroll check is being issued.

- Hours Worked: The number of hours worked during the pay period (if applicable).

- Hourly Rate or Salary: The employee’s pay rate or salary amount.

- Deductions: Any deductions for taxes, insurance, retirement plans, or other benefits.

- Pay Period: The range of dates the pay covers (e.g., weekly, bi-weekly, monthly).

Step 3: Input Employee Information Into the Tool

Once you have all the necessary details, go to your chosen free payroll check maker and input the employee’s information into the tool. This typically involves entering:

- Employee name and address

- Pay period dates

- Number of hours worked (for hourly employees)

- Pay rate (hourly or salary)

- Tax deductions and benefits

Most free payroll check makers will have simple forms or fields to input this data. Be sure to double-check the information for accuracy before moving on.

Step 4: Review the Payroll Check

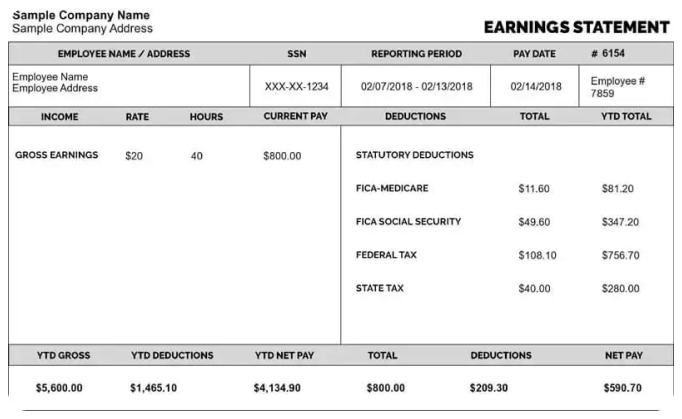

After entering the necessary information, the free payroll check maker will calculate the employee’s gross pay, deductions, and net pay. At this point, you’ll want to review the payroll check to make sure everything is correct.

Ensure that:

- The employee’s hours are accurate

- Tax calculations are correct

- Deductions (such as health insurance or retirement contributions) are accurate

- The total net pay is correct

If everything looks good, you can proceed to the next step.

Step 5: Customize the Payroll Check

Most free payroll check makers allow you to customize your paychecks. This is where you can add your company logo, change fonts, and adjust the layout of the paycheck. Customization helps to make your payroll checks look more professional and aligned with your business branding.

Ensure that your paychecks include all the required details:

- Employee name and address

- Pay period

- Gross pay, deductions, and net pay

- Your business name and contact information

- Any other necessary information (such as a check number or payment method)

Step 6: Generate and Download the Payroll Check

Once you’ve reviewed and customized your payroll check, you can generate it. Most tools will give you the option to download the check as a PDF, which you can either print or email directly to your employees.

If you’re using paper checks, you can print them on check paper that is compatible with your printer. Be sure to follow any specific instructions from your free payroll check maker regarding printing formats to ensure that everything lines up correctly on the check.

Step 7: Distribute the Paychecks

After generating your payroll checks, it’s time to distribute them to your employees. You can either print and hand them out physically or email them directly if your employees prefer digital copies.

If you’re working with freelancers or contractors, you can send their paychecks electronically through bank transfers or payment platforms like PayPal, Venmo, or direct deposit, if supported by your free payroll check maker.

Top Free Payroll Check Makers to Consider

Here are some popular free payroll check makers that you can use to generate professional paychecks:

-

Wave Payroll – Free for freelancers and very simple to use. It includes tax calculations, making it ideal for those with simple payroll needs.

-

PayStubCreator – This tool is designed to help you create pay stubs and paychecks quickly, with options for customizing the design.

-

Online Pay Stub Generator – A quick and easy tool for generating pay stubs and payroll checks, especially for freelancers and small businesses.

-

QuickBooks Payroll – Offers a free version with basic payroll functionality, making it great for small businesses or solopreneurs.

-

Check Stub Maker – A free, no-fuss tool that allows you to create paychecks in just a few minutes. It’s simple and perfect for freelancers or businesses with a small team.

Conclusion

Creating professional payroll checks doesn’t have to be expensive or complicated. By using a free payroll check maker, you can generate accurate, professional paychecks quickly and efficiently. These tools are ideal for small business owners, freelancers, and startups who need a cost-effective solution for managing payroll.

With the steps outlined in this blog, you can easily create professional payroll checks, customize them to your liking, and ensure that your employees are paid accurately and on time. Whether you choose to print checks or send them electronically, these free payroll check makers can streamline your payroll process and help you focus on growing your business.