Managing payroll can be one of the most challenging aspects of running a small business. From ensuring accurate payments to keeping track of taxes and deductions, it’s a task that requires time, attention, and accuracy. Fortunately, a paystub creator can make this process significantly easier. In this blog, we’ll explore how a paystub creator simplifies payroll for small businesses, detailing the key benefits and features that make it an essential tool for any entrepreneur.

What is a Paystub Creator?

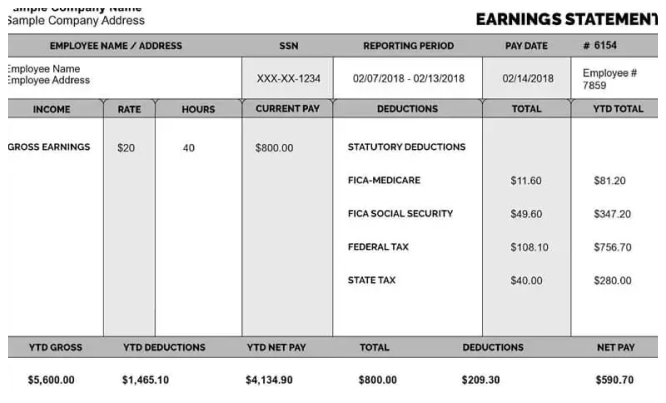

A paystub creator is an online tool that allows business owners to generate pay stubs for their employees easily. Pay stubs detail an employee’s earnings for a specific pay period, including gross pay, deductions (like taxes and insurance), and net pay. For small businesses, having accurate and professional pay stubs is crucial for maintaining good relationships with employees and complying with tax regulations.

Why Small Businesses Need a Paystub Creator

Before diving into the specifics of how a paystub creator can help, let’s look at some reasons why small businesses should consider using one:

- Accuracy: Manual calculations can lead to mistakes. A paystub creator automates these calculations, ensuring accurate pay stubs every time.

- Time Savings: Creating pay stubs from scratch can be time-consuming. A paystub creator streamlines the process, allowing business owners to focus on other essential tasks.

- Professionalism: Well-designed pay stubs enhance the professionalism of your business, fostering trust and credibility among employees.

- Record Keeping: Digital pay stubs simplify record-keeping, making it easier to manage finances and prepare for tax season.

Now, let’s explore how a paystub creator simplifies payroll for small businesses in more detail.

1. User-Friendly Interface

One of the most significant advantages of a paystub creator is its user-friendly interface. Many platforms are designed with simplicity in mind, allowing business owners to navigate the tool easily. This means that even those who are not tech-savvy can create pay stubs without frustration. A straightforward design enables you to input employee information quickly and efficiently.

Example

Imagine you’re a small business owner with just a few employees. With a user-friendly paystub creator, you can enter each employee’s name, pay period, and earnings in just a few clicks. The intuitive layout guides you through the process, making it hassle-free.

2. Automatic Calculations

Manual calculations can lead to errors that can affect employee satisfaction and compliance with tax laws. A paystub creator automates these calculations, taking the burden off your shoulders. This feature ensures that gross pay, deductions, and net pay are calculated correctly every time.

Example

Let’s say one of your employees earns $2,000 before taxes, and you have to deduct federal tax, state tax, and other deductions. Instead of calculating each deduction manually, the paystub creator does it for you. This eliminates the risk of miscalculating an employee’s take-home pay.

3. Customizable Templates

A paystub creator often offers customizable templates that allow you to personalize your pay stubs. You can add your business logo, select color schemes, and include any specific information relevant to your business.

Example

If you run a graphic design firm, you might want your pay stubs to reflect your brand’s creative identity. A customizable paystub creator lets you design pay stubs that align with your branding, enhancing your professionalism and company image.

4. Comprehensive Deduction Options

Different employees may have various deductions, such as health insurance, retirement contributions, and taxes. A good paystub creator allows you to input multiple types of deductions and provides detailed breakdowns for each. This ensures that all necessary information is included on the pay stub.

Example

Imagine one employee opts into a health insurance plan while another contributes to a retirement account. A paystub creator will allow you to enter these deductions accurately for each employee, ensuring everyone receives a correct pay stub.

5. Multiple Pay Frequency Support

As a small business, your pay frequency might vary. Some employees may be paid weekly, while others might be paid biweekly or monthly. A reliable paystub creator supports multiple pay frequencies, enabling you to generate pay stubs that align with your payment schedule.

Example

If you have contractors who are paid weekly and full-time employees who are paid biweekly, the paystub creator allows you to handle both scenarios seamlessly, making payroll management simpler.

6. Secure Data Storage

When dealing with sensitive information, security is crucial. Look for a paystub creator that offers secure data storage options to protect your employees’ personal information. Many reputable paystub creators use encryption and secure cloud storage to safeguard your data.

Example

Imagine storing your employees’ social security numbers and bank information. A secure paystub creator ensures that this sensitive data is protected from unauthorized access, giving you peace of mind.

7. Accessibility Across Devices

A good paystub creator should be accessible from multiple devices, including desktops, tablets, and smartphones. This flexibility allows you to create pay stubs on the go, which is especially useful for busy small business owners.

Example

If you’re at a coffee shop and need to create pay stubs for your employees, you can do so using your tablet or smartphone. This convenience helps you stay on top of payroll, no matter where you are.

8. Preview Option

Before finalizing a pay stub, it’s important to review it for accuracy. A paystub creator that offers a preview option allows you to see what the final document will look like before you download or print it. This feature helps you catch any mistakes or make last-minute changes.

Example

After entering all the information, you can preview the pay stub to ensure everything looks correct. If you notice a typo in an employee’s name or an incorrect deduction, you can quickly fix it before generating the final document.

9. Customer Support

Reliable customer support can make a significant difference when using a paystub creator. If you encounter technical issues or have questions about how to use the tool, responsive customer support can help resolve your concerns quickly.

10. Affordability and Pricing Plans

When choosing a paystub creator, consider the pricing structure. Some tools offer free basic services, while others may have monthly subscriptions or pay-per-use plans. Evaluate your budget and choose a paystub creator that provides a fair price for the features you need.

How to Use a Paystub Creator

Using a paystub creator is generally straightforward. Here’s a simple step-by-step guide to help you get started:

Step 1: Sign Up for an Account

Most paystub creators will require you to create an account. This usually involves providing your email address and creating a password.

Step 2: Input Employee Information

Enter the necessary details about each employee, such as their name, address, and identification numbers. If you have multiple employees, many platforms allow you to save templates for quick access later.

Step 3: Specify the Pay Period

Select the pay period for which you’re generating the pay stub. This could be weekly, biweekly, or monthly.

Step 4: Enter Earnings and Deductions

Input the gross pay and any deductions for that pay period. The paystub creator will automatically calculate the net pay based on the information you provide.

Step 5: Review and Customize

Once you’ve entered all the information, review the pay stub for accuracy. Customize the design to include your company logo and branding elements, if desired.

Step 6: Generate and Save

After reviewing and customizing, generate the pay stub. You can usually download it as a PDF or print it directly. Make sure to save copies for your records.

Step 7: Distribute

Distribute the pay stubs to your employees promptly. Ensuring timely delivery helps maintain transparency and trust.

Conclusion

In summary, a Free paystub creator is an invaluable tool for small businesses, simplifying the payroll process and enhancing accuracy. By providing features like automatic calculations, customizable templates, and secure data storage, a paystub creator enables small business owners to manage payroll with confidence.

Investing in a quality paystub creator not only saves time and reduces errors but also helps you maintain professionalism in your business operations. Whether you’re a freelancer, a small business owner, or managing a team, having accurate and professional pay stubs will help you meet your financial responsibilities while building strong relationships with your employees.

By taking advantage of a paystub creator, you can streamline your payroll process, improve efficiency, and focus on what truly matters—growing your business and achieving your goals. Consider integrating a paystub creator into your business operations and experience the benefits it brings to your payroll management.

Related Articles

How to Access Your MyHTSpace Pay Stub?

How to Get a Check Stub From TruBridge?

Everything You Need to Know About Your Ford Paycheck Stubs

How to Obtain Hobby Lobby Pay Stubs: A Detailed Guide

The Importance of Tracking Your Family Dollar Paystub for Tax Season

What is an eStub and How Does It Simplify Payroll Management?

How Does Verizon Paystub Help Ensure Payroll Accuracy and Transparency?

Understanding Your Pasadena Unified Paystub: A Quick Breakdown