With regards to pursuing informed choices, understanding business sector opinion plays a vital part, one of the best instruments for checking opinion is the Put/Call Ratio, which assists brokers with evaluating whether the market is inclining bullish or negative. By researching the volume of calls and decisions, dealers can expect potential market moves.

What is the Put/Call Ratio?

The Put/Call Ratio is an estimation used to measure market feeling by differentiating the volume of put decisions from bring decisions over a specific period.

Put choices give brokers the option to sell a resource at a foreordained cost, for the most part demonstrating negative feelings, while call choices award the option to purchase, reflecting a bullish opinion.

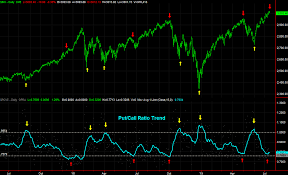

The PCR Proportion is determined as the complete put choice volume partitioned by the all-out call choice volume. A higher proportion recommends a negative viewpoint, though a lower proportion demonstrates a bullish market opinion. Merchants utilize this proportion to measure possible inversions and affirm existing patterns.

How to Interpret the Put/Call Ratio

- The PCR Proportion fills in as an antagonist marker, implying that outrageous qualities frequently demonstrate expected inversions in market patterns.

- PCR Proportion < 0.7 (Low PCR Proportion): A proportion beneath 0.7 recommends that brokers are transcendently purchasing call choices, showing a bullish opinion. In any case, exorbitant good faith might flag that the market is overbought and due for a remedy.

- PCR Proportion Around 1: A proportion near 1 proposes a reasonable market with serious areas of strength for no or negative tendency.

- PCR Proportion > 1 (High PCR Proportion): A proportion over 1 implies that put choice volumes are higher than call choices, showing a negative opinion. This could recommend that financial backers support against market slumps. In any case, outrageous negativity can likewise indicate an oversold market, possibly prompting a bounce back.

Practical Applications of the PCR Ratio in Trading

1. Affirming Business sector Patterns

The PCR Proportion can assist with affirming continuous market patterns. On the off chance that a bullish market has a PCR Proportion reliably under 1, it shows solid force. Likewise, if a negative market has a proportion over 1, the downtrend may proceed.

2. Spotting Business sector Inversions

Outrageous qualities in the PCR Ratio frequently propose market inversions. For example, a very high PCR Extent (>1.5) could mean extreme fear watching out, conceivably inciting a short-covering rally. Then again, an extremely low PCR Extent (<0.5) could exhibit over-the-top completely pure intentions and hail a probable pullback.

3. Supporting Other Specialized Markers

The PCR Ratio ought not to be utilized in seclusion but rather related to other specialized markers like moving midpoints, Relative Strength Record (RSI), and Bollinger Groups. For instance, if the PCR Proportion is high and the RSI demonstrates an oversold market, a potential purchasing opportunity might emerge.

4. Assessing Sector-Specific Sentiment

Dealers dissect the PCR Proportion for explicit areas or individual stocks to check opinions inside specialty showcases. A rising PCR proportion in the innovation area might demonstrate financial backer wariness regardless of solid basics and to introduce an antagonist purchasing a valuable open door.

Limitations of the PCR Ratio

While the Put/Call Proportion is an important device, it has a few limits:

1. Trailing result

PCR Proportion reflects past choice volumes, making it receptive instead of prescient.

2. Market Setting Matters

A high PCR proportion in a buyer market may not necessarily in every case show a slump, as financial backers frequently use puts for support.

3. Outrageous Qualities Aren’t Consistently Inversion Signs

Some of the time, markets remain overbought or oversold for expanded periods, requiring extra affirmation before making exchanges.

Conclusion

The Put/Call Proportion (PCR Proportion) is a fundamental apparatus for brokers looking to check market opinion and settle on informed choices. By understanding how call and put choice volumes look, merchants can distinguish patterns, expect inversions, and upgrade their exchange systems. Be that as it may, for best outcomes, it ought to be joined with other specialized pointers and key examinations.

For brokers hoping to remain ahead in unpredictable business sectors, checking the PCR Proportion close by market patterns can offer a huge edge in executing productive exchanges.