In today’s fast-paced business world, staying organized is key, especially when it comes to financial records. Whether you’re a freelancer, a small business owner, or an employee, managing paychecks and pay stubs accurately is crucial for smooth operations. One tool that can make this process a whole lot easier is a check stub maker. But what exactly is it, and why should you consider using one?

In this blog, we’ll explore the magic of a check stub maker, how it works, and why it’s a game-changer for both employees and employers. We’ll cover everything you need to know, from understanding what a check stub is to the benefits of using a stub maker for your business or personal finances. Let’s dive in!

What Is a Check Stub?

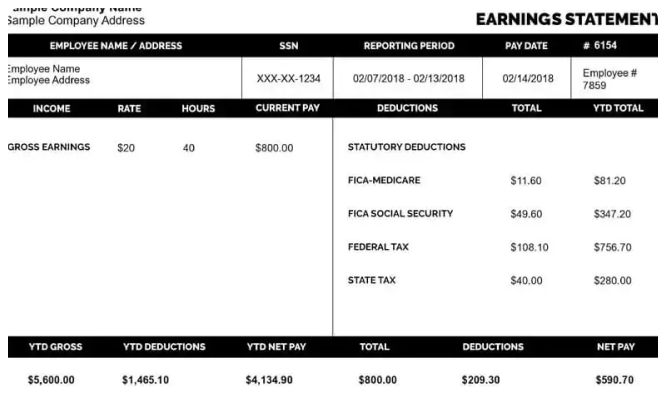

Before we get into the details of how a check stub maker works, let’s first define what a check stub is. A check stub, also known as a pay stub or paycheck stub, is a document provided by an employer to their employee that breaks down their pay. This document outlines the employee’s earnings for a given pay period, any deductions made (like taxes, insurance, and retirement contributions), and the net amount the employee will take home.

Here’s a quick breakdown of what typically appears on a check stub:

- Gross Pay: The total amount earned before any deductions.

- Deductions: The amounts taken out of the paycheck, such as federal and state taxes, insurance premiums, and retirement contributions.

- Net Pay: The amount the employee takes home after deductions.

- Pay Period: The timeframe for which the employee is being paid.

- Employer and Employee Information: Including names, addresses, and any other relevant details.

What Is a Check Stub Maker?

A check stub maker is a tool or software that allows employers, freelancers, and business owners to create professional-looking pay stubs. Instead of manually calculating the earnings and deductions or relying on complicated payroll systems, a check stub maker simplifies the process. It does this by providing pre-built templates where users can input necessary data, and in just a few clicks, generate a professional check stub.

Check stub makers can be used by a variety of people, including:

- Small business owners: If you’re running a small business and need to issue pay stubs to your employees, a check stub maker can save you time and effort.

- Freelancers: As a freelancer, creating pay stubs for your clients can enhance your professionalism and establish clear financial records.

- Employees: If you’re paid in cash or by check, and you want to create a pay stub for your own record-keeping or to provide proof of income, a stub maker is perfect.

Why Use a Check Stub Maker?

Now that we know what a check stub maker is, let’s explore why it’s such an important tool for both individuals and businesses. Here are some of the key benefits:

1. Simplifies the Pay Stub Creation Process

Creating pay stubs manually can be a time-consuming process, especially if you have multiple employees or clients. With a check stub maker, you simply enter the required information—like earnings, taxes, and deductions—and the tool will automatically generate a clean, professional pay stub. This simplicity saves you valuable time and energy, allowing you to focus on other important tasks.

2. Saves Money

Hiring a payroll service or accountant to generate pay stubs can be expensive, especially for small businesses or freelancers. A check stub maker is a cost-effective alternative, allowing you to generate as many pay stubs as you need at a fraction of the cost. Many online check stub makers are available for a low monthly fee or even on a pay-per-use basis, making it affordable for businesses of any size.

3. Improves Accuracy

When creating pay stubs manually, there’s always the risk of making mistakes—whether it’s calculating the correct amount of taxes or forgetting a deduction. A check stub maker takes care of these calculations automatically, minimizing the chances of errors. The tool will ensure that all the required information is included, from tax deductions to benefits, providing accuracy every time.

4. Enhances Professionalism

For freelancers and small business owners, presenting a professional image is essential. Using a check stub maker to generate pay stubs gives you a polished, consistent format that can be shared with clients or employees. This not only increases trust but also boosts your credibility. It shows that you are organized, transparent, and serious about your business.

5. Keeps Your Records Organized

For business owners and freelancers, record-keeping is crucial for tax purposes and financial planning. A check stub maker keeps all your pay stubs neatly organized, making it easy to track earnings and deductions over time. Many check stub makers even offer digital storage, so you can access your records whenever you need them. This is especially helpful during tax season or when you need to show proof of income for a loan or mortgage application.

6. Provides Instant Access

Gone are the days of waiting for paper pay stubs or worrying about misplacing important documents. With a digital check stub maker, you can access your pay stubs instantly, as soon as they are generated. Whether you need a pay stub for an employee or a client, the ability to access it immediately adds convenience and efficiency to your workflow.

How Does a Check Stub Maker Work?

Using a check stub maker is simple, even if you don’t have a background in payroll. Here’s how the process generally works:

- Choose a Check Stub Maker Tool

There are many check stub makers available online, both free and paid. When choosing a tool, make sure it’s reputable and offers all the features you need. Some popular options include QuickBooks, PayStubCreator, and CheckStubMaker. - Select a Template

Once you’ve chosen your check stub maker, select a template. Most tools offer a variety of templates to choose from, based on the type of pay stub you need (freelance, salary, hourly, commission-based, etc.). - Enter Your Information

Input the relevant details, such as:- Employee name and address

- Employer name and address

- Pay period (weekly, bi-weekly, monthly, etc.)

- Gross pay (before deductions)

- Deductions (taxes, benefits, etc.)

- Net pay (after deductions)

- Any other relevant information (bonuses, commissions, etc.)

- Generate the Pay Stub

After entering all the details, simply hit the “generate” button. The check stub maker will automatically calculate the deductions and generate a professional-looking pay stub. - Download or Print

Once your pay stub is ready, you can download it as a PDF or print it out directly. Many check stub makers also offer cloud storage options, so you can keep a digital copy for future reference.

Who Can Benefit from a Check Stub Maker?

A check stub maker isn’t just for large corporations. It’s a helpful tool for a wide range of individuals and businesses, including:

- Small Business Owners: Small business owners who need to issue pay stubs to their employees can use a check stub maker to save time and money.

- Freelancers and Contractors: Freelancers and contractors can use a check stub maker to create professional pay stubs for clients, improving their image and maintaining financial records.

- Employees: Employees who want to create their pay stubs for record-keeping or tax purposes can benefit from using a check stub maker.

- Bookkeepers and Accountants: Bookkeepers and accountants who need to create pay stubs for multiple clients can use check stub makers to streamline the process.

Conclusion

A check stub maker is a powerful tool for anyone who needs to create pay stubs, whether you’re an employer, freelancer, or employee. It simplifies the process, saves time and money, improves accuracy, and helps keep your financial records organized. Whether you’re issuing pay stubs for your employees or creating a professional record of your freelance earnings, using a check stub maker can make a huge difference in your workflow.

If you’re looking to bring more efficiency and professionalism to your payroll or personal finances, it’s time to embrace the magic of a check stub maker. With just a few clicks, you’ll have a clean, accurate pay stub ready to go, allowing you to focus on what matters—growing your business or career.

Related Articles

How to Access Your MyHTSpace Pay Stub?

How to Get a Check Stub From TruBridge?

How To Get Paystub From Zachary

Everything You Need to Know About Your Ford Paycheck Stubs

How to Obtain Hobby Lobby Pay Stubs: A Detailed Guide

The Importance of Tracking Your Family Dollar Paystub for Tax Season