In today’s fast-paced world, businesses are constantly looking for ways to streamline their operations and save time and money. One area that has seen significant changes is payroll processing. Traditionally, businesses have relied on payroll companies or in-house accounting teams to generate pay stubs for employees. However, with the rise of digital tools, many businesses are turning to check stub makers as a modern alternative. But is a check stub maker truly better than traditional payroll methods? Let’s dive in and compare both options to help you decide which is the best fit for your business.

What Is a Check Stub Maker?

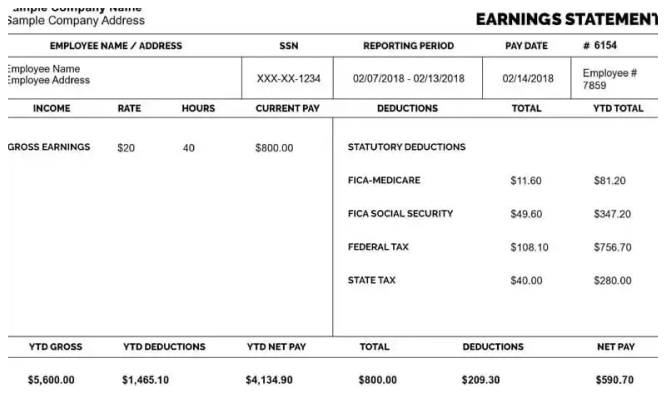

A free check stub maker is an online tool or software that allows businesses and individuals to create pay stubs (also known as paycheck stubs or earnings statements) quickly and easily. These tools are designed to generate real check stubs that accurately reflect an employee’s earnings, deductions, and other important payroll details.

Check stub makers typically offer a simple, user-friendly interface where users can input necessary information like employee names, pay rates, working hours, tax deductions, and more. The software then automatically generates a printable pay stub that can be provided to employees either in digital form or as a physical copy.

Traditional Payroll: How It Works

Traditional payroll refers to the conventional method of processing employee wages using either an in-house payroll department or third-party payroll service providers. The process typically involves manually entering employee work hours, calculating wages, deducting taxes, and producing pay stubs for each employee. This can be done either on paper or electronically, but the key difference is that it’s usually handled by a person (or a team of people) rather than an automated system.

In traditional payroll setups, businesses often use accounting software or hire payroll professionals to ensure all calculations are accurate. Some businesses outsource payroll tasks to third-party providers like ADP, Paychex, or QuickBooks, who take care of the entire process from start to finish. This method can be time-consuming and costly, especially for small businesses that lack the resources for a dedicated payroll department.

The Pros and Cons of a Check Stub Maker

Pros:

- Cost-Effective: One of the biggest advantages of using a check stub maker is that it’s incredibly affordable. You don’t need to pay for an entire payroll service or hire an accountant to handle payroll for you. Many online check stub makers offer pay-as-you-go pricing or affordable subscription plans, making them ideal for small businesses or individuals with limited budgets.

- Ease of Use: Check stub makers are designed to be user-friendly. You don’t need to be a payroll expert to create accurate pay stubs. The software walks you through the process and generates pay stubs quickly. This is especially helpful for small business owners who want to avoid the complexity of traditional payroll systems.

- Fast Processing: With a check stub maker, you can create and download pay stubs in just a few minutes. This is much faster than waiting for a payroll company to process your payroll and send out pay stubs.

- Accuracy: Check stub makers typically have built-in features that automatically calculate taxes, deductions, and benefits. This can help reduce errors that might occur when calculating pay manually, especially if you’re unfamiliar with tax laws.

- Convenience: Since check stub makers are online tools, you can access them anytime, anywhere, as long as you have an internet connection. This allows you to manage payroll on your own schedule without having to rely on external companies.

- Digital Records: Pay stubs created with a check stub maker are stored digitally. This makes it easy to keep records of all pay stubs for your employees in one place, making future reference and audits more convenient.

Cons:

- Limited Features: While check stub makers are excellent for generating pay stubs, they typically don’t offer the full range of payroll services that traditional payroll providers do. For example, they might not handle tax filing, direct deposit, or year-end reporting like a full-service payroll company would.

- Lack of Support: Some check stub makers may not provide the level of customer support that larger payroll services offer. If you run into issues with the tool or have questions, you may not get the instant help you need.

- Security Concerns: Since check stubs are created and stored online, you need to ensure that the platform you’re using is secure. Protecting sensitive payroll information should always be a priority, and some smaller check stub makers might not have the security measures in place that larger payroll providers offer.

The Pros and Cons of Traditional Payroll

Pros:

- Comprehensive Services: Traditional payroll providers, like ADP or Paychex, offer comprehensive services that go beyond simply generating pay stubs. They can handle tax filing, direct deposit, year-end reporting, and even employee benefits management. For businesses that need a complete payroll solution, these services can be invaluable.

- Expert Support: When you outsource payroll, you have access to expert support from professionals who understand the ins and outs of payroll processing, taxes, and compliance. This can be particularly helpful for businesses that don’t have in-house payroll expertise.

- Tax Filing and Compliance: Traditional payroll services are designed to ensure that your business complies with all local, state, and federal tax regulations. They calculate, withhold, and file taxes on your behalf, reducing the risk of errors or penalties.

- Time Savings: If you don’t have the time or resources to manage payroll in-house, outsourcing payroll to a traditional provider can save you a significant amount of time. You don’t have to worry about calculating wages, handling tax filings, or keeping track of deductions.

Cons:

- Higher Costs: Traditional payroll services tend to be more expensive than using a check stub maker. These providers charge monthly or per-employee fees, which can add up quickly, especially for small businesses with a limited budget.

- Complexity: Traditional payroll systems can be more complicated to use, especially if you’re handling payroll in-house. It requires knowledge of tax laws, benefit plans, and various payroll regulations, which can be overwhelming for those without experience.

- Slower Processing: Depending on the service provider, traditional payroll processing can take longer than using a check stub maker. It might take several days for payroll providers to process and distribute pay stubs, compared to the instant results you get with a check stub maker.

- Limited Flexibility: Once you’ve chosen a traditional payroll service, you’re often locked into their system and may have limited flexibility in terms of customization. Some providers may charge extra fees for custom reports or additional services.

Which Option Is Better for Your Business?

The answer depends on your specific needs and the size of your business. Here’s a quick guide to help you decide:

Choose a Check Stub Maker If:

- You’re a small business owner with a tight budget and don’t need a full payroll service.

- You have a small team and prefer to handle payroll tasks on your own.

- You need quick, easy-to-generate pay stubs and don’t require additional services like tax filing or direct deposit.

- You want a simple, cost-effective solution for creating real check stubs that comply with payroll requirements.

Choose Traditional Payroll If:

- You need a full-service payroll solution with support for tax filing, direct deposit, and employee benefits management.

- You don’t have the time or expertise to handle payroll on your own.

- Your business has multiple employees and requires a more structured payroll system with expert assistance.

- You want to avoid the risk of errors in payroll and need a professional to ensure compliance with tax regulations.

Conclusion: Is a Check Stub Maker Right for You?

A check stub maker can be a great tool for businesses that want to simplify payroll without the need for a full-service payroll provider. It offers a fast, affordable, and user-friendly solution for generating pay stubs, which can save time and money for small businesses or freelancers. However, if you need more comprehensive payroll services, such as tax filing, compliance, and employee benefits management, a traditional payroll service might be the better choice.

Ultimately, the best solution for your business depends on your specific needs. If you’re just looking for a quick and easy way to generate real check stubs, a check stub maker is a great option. But for larger businesses with more complex payroll needs, traditional payroll services might be the way to go.

Related Articles

How to Access Your MyHTSpace Pay Stub?

How to Get a Check Stub From TruBridge?

How To Get Paystub From Zachary

Everything You Need to Know About Your Ford Paycheck Stubs

How to Obtain Hobby Lobby Pay Stubs: A Detailed Guide

The Importance of Tracking Your Family Dollar Paystub for Tax Season