In the digital era, financial transactions have become more seamless, allowing consumers to shop online, pay bills, and transfer funds with a few clicks. While this convenience has transformed the financial landscape, it has also created a breeding ground for cybercriminals. Among the growing threats, credit card fraud is one of the most pervasive. Platforms like Bclub, which provide access to stolen credit card data, have become key players in enabling fraud. we will explore how the Bclub login system and the illegal sale of dumps and CVV2 codes contribute to the rise of credit card fraud and what individuals and businesses can do to protect themselves.

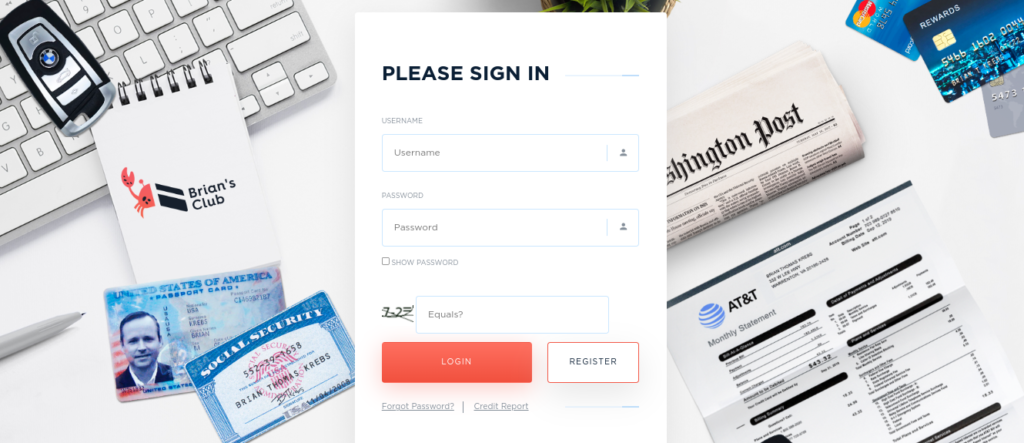

Understanding the Bclub Login and Its Role in Cybercrime

Bclub is an underground online marketplace where criminals can buy and sell stolen credit card data, including dumps and CVV2 codes. The Bclub login is the entry point for cybercriminals looking to access this illicit marketplace, where stolen credit card information is traded in bulk. Once logged in, fraudsters can easily browse through a variety of stolen credit card dumps—magnetic stripe data from credit cards—and CVV2 codes, which are the three- or four-digit numbers found on the back of credit cards used to authorize online transactions.

Dumps contain detailed information about a stolen credit card, including the cardholder’s name, account number, expiration date, and even the PIN in some cases. With this data, criminals can clone the stolen credit card and use it for both online and offline purchases. CVV2 codes, on the other hand, are primarily used for online transactions, allowing fraudsters to bypass payment gateways and complete fraudulent purchases.

The ease with which cybercriminals can log into Bclub and purchase stolen data has made it a popular platform for committing fraud. By offering stolen credit card data in bulk, Bclub has become a key player in the global credit card fraud market, facilitating the unauthorized use of credit cards on a massive scale.

The Dangers of Dumps and CVV2 Shops

The illegal sale of dumps and CVV2 codes has given rise to a new wave of credit card fraud. Cybercriminals can acquire large volumes of stolen data through platforms like Bclub, which enables them to conduct fraud on an industrial scale. The availability of these data sets has made it easier than ever for fraudsters to carry out unauthorized transactions without detection.

Dumps are typically used by fraudsters to clone physical credit cards. Using the stolen data, criminals encode the information onto blank magnetic strips and create counterfeit cards that are then used for in-person transactions, such as making purchases at retail stores or withdrawing cash from ATMs. This form of fraud can go unnoticed for days or even weeks, depending on the sophistication of the fraud detection system in place at the store or ATM.

The Consequences for Consumers

Consumers are the most vulnerable victims of credit card fraud, and the rise of platforms like Bclub only amplifies this threat. When a criminal logs into Bclub and purchases stolen credit card data, they can begin using it for fraudulent transactions. This typically starts with unauthorized online purchases, where the fraudster uses a combination of stolen credit card information and CVV2 codes to bypass verification systems.

The effects on consumers can be devastating. Once fraudsters gain access to their credit card information, victims may notice unfamiliar charges on their accounts, or they may receive notices of unauthorized transactions. While many credit card companies offer some level of fraud protection, the process of disputing fraudulent charges can be long and stressful. Additionally, the stolen information can be used for identity theft, where criminals open new accounts in the victim’s name or make further unauthorized purchases.

How to Protect Yourself From Credit Card Fraud

As a consumer, there are several steps you can take to protect yourself from credit card fraud. First, regularly monitor your credit card statements for any unauthorized transactions. The quicker you identify fraud, the faster you can report it and limit the damage.

When shopping online, always ensure that the website you are purchasing from uses HTTPS encryption to secure your payment details. Avoid using public Wi-Fi networks when making purchases, as these can be easily intercepted by hackers.

Another important step is to use multi-factor authentication (MFA) whenever possible. Many banks and credit card companies offer this additional layer of security, which can help protect your accounts from unauthorized access.

The Impact on Businesses

While consumers are the direct victims of fraud, businesses also suffer severe consequences when credit card fraud occurs. Chargebacks are one of the most common and costly issues that businesses face as a result of fraudulent transactions. A chargeback occurs when a customer disputes a transaction, claiming that their credit card was used without their authorization. The business is then required to refund the full amount of the purchase, even though the goods or services have already been provided.

For online businesses, the situation can be even more complicated. Fraudsters who use stolen credit card information and CVV2 codes for online transactions can often bypass basic security measures, making it difficult for businesses to identify fraudulent orders in real time. As a result, businesses may ship products to fraudulent buyers, only to later face chargebacks and loss of revenue.

The financial impact of chargebacks can be significant, especially for small businesses. Not only do businesses lose money from refunded transactions, but they also risk incurring additional penalties from payment processors. Payment processors often impose fines on businesses that fail to comply with regulations designed to prevent fraud, and in severe cases, businesses may be removed from payment networks entirely.

How Law Enforcement is Tackling the Problem

Law enforcement agencies around the world are working tirelessly to combat credit card fraud and the underground markets that facilitate it. However, platforms like Bclub make it difficult for authorities to track and apprehend criminals involved in credit card fraud. These platforms often operate on the dark web, making it challenging for law enforcement to gather intelligence and take action.

Despite these challenges, law enforcement agencies, including the FBI, Europol, and others, have made significant strides in shutting down underground marketplaces that sell stolen credit card data. In recent years, international efforts have led to the dismantling of several large dark web marketplaces, and many individuals involved in the trafficking of stolen data have been arrested.

However, as one marketplace is shut down, others continue to emerge. The rise of encrypted communication tools and anonymous payment methods makes it harder for authorities to track criminals and disrupt their operations. This ongoing game of cat and mouse between cybercriminals and law enforcement requires continuous adaptation and collaboration across borders.

Law Enforcement and the Battle Against Credit Card Fraud

While law enforcement agencies are aware of the dangers posed by platforms like Bclub.win, the anonymity of the dark web makes it difficult to track and prosecute criminals involved in the sale of stolen credit card data. However, international efforts are being made to combat these illicit marketplaces. Authorities such as the FBI, Europol, and other law enforcement agencies around the world have worked together to shut down illegal online marketplaces and arrest individuals involved in credit card fraud schemes.

Despite these efforts, the problem persists. For every dark web marketplace that is taken down, others emerge in its place. Criminals continue to adapt, finding new ways to anonymize their activities and evade detection. This ongoing cat-and-mouse game between law enforcement and cybercriminals has made it increasingly difficult to fully eradicate credit card fraud.

How to Protect Yourself from Credit Card Fraud

As a consumer, there are several precautions you can take to reduce the risk of becoming a victim of credit card fraud. First, it is essential to monitor your credit card statements regularly for unauthorized charges. The sooner you detect fraudulent transactions, the sooner you can report them and limit potential damage.

Second, always shop on secure websites that use HTTPS encryption. This ensures that your credit card information is transmitted securely. Avoid using public Wi-Fi networks when making purchases, as they can be easily intercepted by cybercriminals.

Conclusion

The rise of platforms like Bclub, which facilitate the sale of stolen credit card data, has made it easier than ever for criminals to engage in large-scale fraud. The availability of credit card dumps and CVV2 codes has amplified the risks faced by both consumers and businesses. While law enforcement agencies continue to work to dismantle these illicit markets, the anonymity of the dark web makes it difficult to fully eradicate the problem.

Consumers and businesses must take proactive measures to protect themselves from the growing threat of credit card fraud. By staying vigilant, using secure payment methods, and implementing stronger security protocols, we can help reduce the risks associated with credit card fraud and safeguard our financial information.