Winning the Mega Millions jackpot is a dream come true for many. It’s the moment when life transforms in the blink of an eye. The possibility of financial freedom, luxury lifestyles, and the chance to fulfill lifelong dreams becomes a reality. But the thrill of winning the lottery is just the beginning of an exciting, yet challenging, journey. Proper planning and responsible decision-making are key to ensuring that your winnings serve you for the rest of your life.

In this blog, we will guide you through a comprehensive plan to secure your future after winning the Mega Millions jackpot or any major lottery like the Euro Jackpot Lottery. We will cover the importance of financial management, investments, lifestyle changes, philanthropy, and more to help you maximize and protect your windfall.

1. Stay Calm and Seek Legal Advice

The first thing to do after winning the Mega Millions jackpot is to remain calm. It’s natural to feel overwhelmed by the life-changing sum of money, but it’s crucial to think clearly and avoid making impulsive decisions. Before you claim your prize, take a moment to secure the right legal and financial advice.

Hire a trustworthy lawyer with experience in lottery winnings to guide you through the legal aspects of your new fortune. They will help you protect your identity, assist in tax planning, and ensure you avoid common pitfalls such as scams or predatory behavior.

In some countries, lottery winners must publicly disclose their identities. In India, if you’ve won an international lottery like the Mega Millions or Euro Jackpot, your legal team can help you navigate privacy laws to keep your winnings and personal information secure.

2. Secure Your Finances Immediately

Once you’ve claimed your prize, securing your finances is the next critical step. Even though it may be tempting to start spending right away, setting up a proper financial strategy will ensure you don’t squander your fortune.

Start by creating a team of trusted professionals, including a financial advisor, an accountant, and a tax specialist. Together, they will help you make smart decisions about how to manage your newfound wealth. You’ll need to understand the tax implications of winning the Mega Millions jackpot, as both India and the United States have taxes on lottery winnings.

It’s also wise to establish a diversified financial plan. This involves creating a budget, setting aside funds for immediate use, and investing in a variety of assets like stocks, bonds, and real estate. These investments will help grow your wealth and provide long-term financial security.

3. Pay Off Debts and Build an Emergency Fund

Before indulging in luxury purchases, consider using part of your winnings to pay off any outstanding debts, including loans, mortgages, or credit card balances. This will give you peace of mind and a clean slate to start your new financial journey.

It’s also a good idea to build an emergency fund. While it may seem unnecessary with millions in the bank, an emergency fund is a safety net for unexpected expenses. It will give you the financial flexibility to handle any unforeseen circumstances without dipping into your investments.

4. Set Financial Goals

With your finances secured, it’s time to think about your future. Setting short-term and long-term financial goals will help you stay on track and prevent reckless spending. Consider questions like:

- Do you want to invest in real estate?

- Are there charitable causes you’re passionate about?

- Do you want to start a business?

- Are you planning to fund your children’s or grandchildren’s education?

By creating clear financial goals, you can allocate your winnings in a way that aligns with your dreams and aspirations. This will ensure that your newfound wealth serves not only your immediate desires but also your future needs.

5. Plan for Investments

One of the smartest ways to make your lottery winnings last is through sound investments. Investing in stocks, bonds, real estate, or even starting a business can grow your wealth over time. A financial advisor will be instrumental in helping you diversify your portfolio and balance risk.

Consider conservative investments for stability, as well as higher-risk options for growth. Real estate is often a popular choice for lottery winners. Whether you want to invest in properties in India or abroad, real estate can provide you with a steady income through rental properties or appreciation in value.

If you’re new to investing, take time to learn about the stock market, mutual funds, and other investment vehicles. This way, you’ll be able to make informed decisions and protect your wealth in the long term.

6. Understand Taxes and International Implications

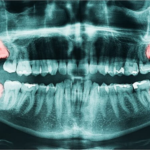

If you’ve won the Mega Millions jackpot or another international lottery like the Euro Jackpot Lottery, understanding the tax implications is crucial. In India, lottery winnings are subject to taxation under Section 194B of the Income Tax Act.

This means that whether you win in India or abroad, the amount you receive will be taxed, and you’ll need to declare it when filing your taxes. Additionally, the United States imposes taxes on winnings from lotteries like Mega Millions for both citizens and non-citizens. This means that as an Indian winner, you could be taxed by both the U.S. and Indian governments.

A tax specialist will help you navigate these complex regulations and find ways to minimize your tax liability, such as through tax treaties or proper tax planning.

7. Manage Lifestyle Changes

Winning the lottery often brings significant lifestyle changes. While it’s exciting to indulge in luxury purchases, it’s important to pace yourself and avoid overspending. Many lottery winners find themselves bankrupt within a few years due to poor money management and lifestyle inflation.

Set a budget for your lifestyle changes. This could include buying a new home, upgrading your car, or taking lavish vacations. However, keep in mind that these purchases should align with your long-term financial plan. Avoid making big decisions without consulting your financial team, and don’t fall prey to the pressure of living an extravagant lifestyle simply because of your wealth.

It’s also essential to maintain a sense of normalcy. Surround yourself with trustworthy friends and family who will support you in making responsible choices. This will help you stay grounded and focused on what truly matters in life.

8. Giving Back Through Philanthropy

Many lottery winners feel a sense of responsibility to give back to society. Philanthropy can be a rewarding way to use your wealth to make a positive impact on the world. Whether it’s supporting education, healthcare, or environmental causes, charitable donations can make a real difference.

If you’re interested in philanthropy, consider setting up a charitable foundation or trust. This can provide a structured way to give back while offering potential tax benefits. A financial advisor can help you create a philanthropic plan that aligns with your values and ensures your donations are used effectively.

9. Estate Planning and Wealth Protection

After winning the Mega Millions jackpot, estate planning is essential to ensure that your wealth is passed on to future generations. This includes drafting or updating your will, setting up trusts for your children or grandchildren, and designating beneficiaries for your assets.

A well-crafted estate plan will protect your wealth from excessive taxes and ensure that your assets are distributed according to your wishes. It’s also important to plan for unforeseen events like illness or incapacity. An estate lawyer can help you navigate these complex issues and provide peace of mind that your legacy is secure.

10. Enjoy Your New Life Responsibly

Winning the Mega Millions jackpot or Euro Jackpot Lottery opens up a world of possibilities, but it’s important to enjoy your wealth responsibly. While it’s natural to want to celebrate your success, balancing fun with financial prudence will ensure that your winnings last a lifetime.

Take time to enjoy the benefits of your new financial freedom, whether it’s traveling the world, pursuing new hobbies, or spending time with loved ones. Just remember to stick to your financial plan and make responsible decisions along the way.

Conclusion

Winning the Mega Millions jackpot or any major lottery like the Euro Jackpot Lottery is a life-changing event. With proper planning, financial management, and responsible decision-making, you can secure your future, enjoy your wealth, and make a positive impact on the world. By following the steps outlined in this guide, you’ll be well-equipped to handle the challenges and opportunities that come with newfound fortune.

India has seen many lottery winners over the years, and with thoughtful planning, you too can turn your jackpot win into lasting success. Whether you choose to invest, give back, or enjoy a luxurious lifestyle, the key is to approach your wealth with wisdom and care.