Managing payroll effectively is crucial for businesses, freelancers, and independent contractors. A reliable check stub maker simplifies the process by ensuring accurate and professional pay documentation. With so many options available, choosing the right check stub maker can be overwhelming. Here are the top features to consider when selecting the best check stub maker for your needs.

1. Ease of Use

A check stub maker should have a user-friendly interface that allows anyone to generate pay stubs without technical expertise. Look for software with a simple, step-by-step process, clear instructions, and an intuitive design that makes it easy to enter information and generate pay stubs quickly.

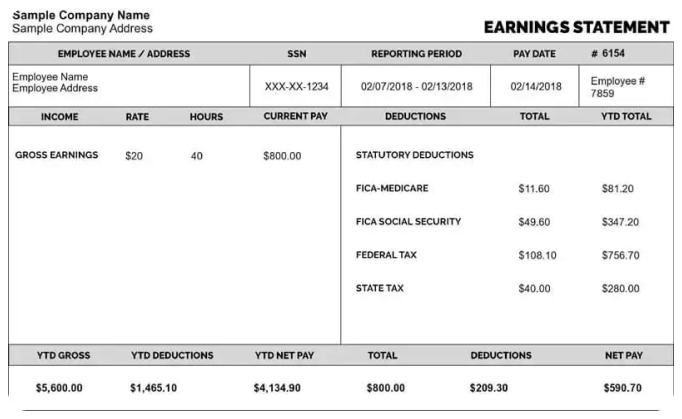

2. Customization Options

Every business has unique payroll needs. A quality check stub maker should offer customization options such as:

- The ability to add your business logo

- Customizable pay period details

- Editable tax and deduction fields

- Various layout and template designs

Customizing stubs ensures they align with your brand and meet the specific requirements of your business or industry.

3. Automatic Tax Calculations

Manual tax calculations can be complicated and prone to errors. A good check stub maker should automatically calculate taxes, deductions, and contributions such as:

- Federal, state, and local taxes

- Social Security and Medicare (FICA)

- Retirement contributions

- Insurance premiums

This feature helps reduce mistakes and ensures compliance with tax regulations.

4. Instant Download and Delivery

Time is valuable, and waiting for pay stubs to process can be frustrating. The best check stub makers provide instant downloads in multiple formats like PDF. Some also offer email delivery options, making it easy to share documents with employees or clients.

5. Security and Data Protection

Payroll information contains sensitive data. A reputable check stub maker should have security features to protect user data, including:

- Encryption to safeguard financial information

- Secure cloud storage options

- Compliance with privacy laws and regulations

Ensuring data security prevents unauthorized access and potential fraud.

6. Mobile Compatibility

With remote work becoming more common, mobile-friendly tools are essential. A check stub maker with a mobile-responsive design allows users to generate pay stubs from smartphones or tablets, providing convenience for on-the-go professionals.

7. Multiple Payment Method Support

Different businesses use different payment methods. A great check stub maker should accommodate:

- Direct deposit information

- Pay by check

- Cash payments

This flexibility ensures that all workers, whether salaried or hourly, receive accurate and clear payment documentation.

8. Error Correction and Preview Feature

Mistakes happen, and correcting them should be easy. A good check stub maker should offer:

- A preview option before finalizing

- The ability to edit errors before generating the stub

- Easy regeneration of corrected stubs

This feature helps avoid costly mistakes and ensures accuracy.

9. Compliance with Labor Laws

Payroll documentation must adhere to labor laws and IRS requirements. A reliable check stub maker should:

- Include legally required information

- Ensure compliance with employment laws

- Provide proper documentation for audits or employee disputes

Following labor laws helps businesses avoid legal issues and ensures transparency.

10. Affordable Pricing and Free Options

Cost is always a consideration. Many check stub makers offer free or budget-friendly plans with essential features. Look for a tool that provides:

- A free version with basic functionalities

- Affordable premium options for more features

- Transparent pricing with no hidden fees

Choosing the right pricing plan ensures that businesses of all sizes can access professional payroll documentation.

11. Customer Support

Reliable customer service is essential for troubleshooting and guidance. When selecting a check stub maker, check for:

- 24/7 customer support availability

- Live chat, email, or phone support

- Detailed FAQs and help guides

Having access to support ensures that any issues or questions can be resolved quickly.

12. Integration with Payroll Systems

Integrating with payroll systems can streamline financial processes for businesses using accounting software. A check stub maker that integrates with tools like QuickBooks, Xero, or other payroll software makes it easier to manage employee payments and financial records.

Conclusion

A check stub maker is an essential tool for businesses, freelancers, and independent contractors looking to simplify payroll processes. You can ensure accurate and professional pay documentation by choosing a solution with ease of use, customization, security, and automatic tax calculations. Whether you’re a small business owner or a gig worker, selecting the right check stub maker will save time, reduce errors, and improve payroll management.