The Best SharkShop Credit Cards for Students and Young Professionals

Are you ready to dive into the world of financial freedom? Whether you’re a student navigating campus life or a young professional making your mark, having the right credit card can be your secret weapon for building credit and managing expenses. In this blog post, we’ll explore the best SharkShop.biz credit cards tailored specifically for students and young pros like you!

From cashback rewards on everyday purchases to low-interest rates that won’t break the bank, we’ve got you covered. So grab your notepad and get ready to unlock exclusive perks that will help you swim confidently through life’s financial waters!

Introduction to credit cards and their importance for students and young professionals

Navigating the world of credit cards can feel like swimming with sharks, especially for students and young professionals just starting their financial journeys. Understanding how to manage a credit card effectively is crucial; it can pave the way for building a solid credit history and unlocking future opportunities. Enter SharkShop,biz a name that stands out in the realm of student-friendly credit options.

With an array of features designed specifically for younger consumers, these cards offer more than just purchasing power; they open doors to rewards and benefits tailored to your lifestyle. Whether you’re budgeting for school supplies or planning your next adventure, having a reliable credit card by your side can make all the difference. Let’s dive into what makes SharkShop credit cards so appealing!

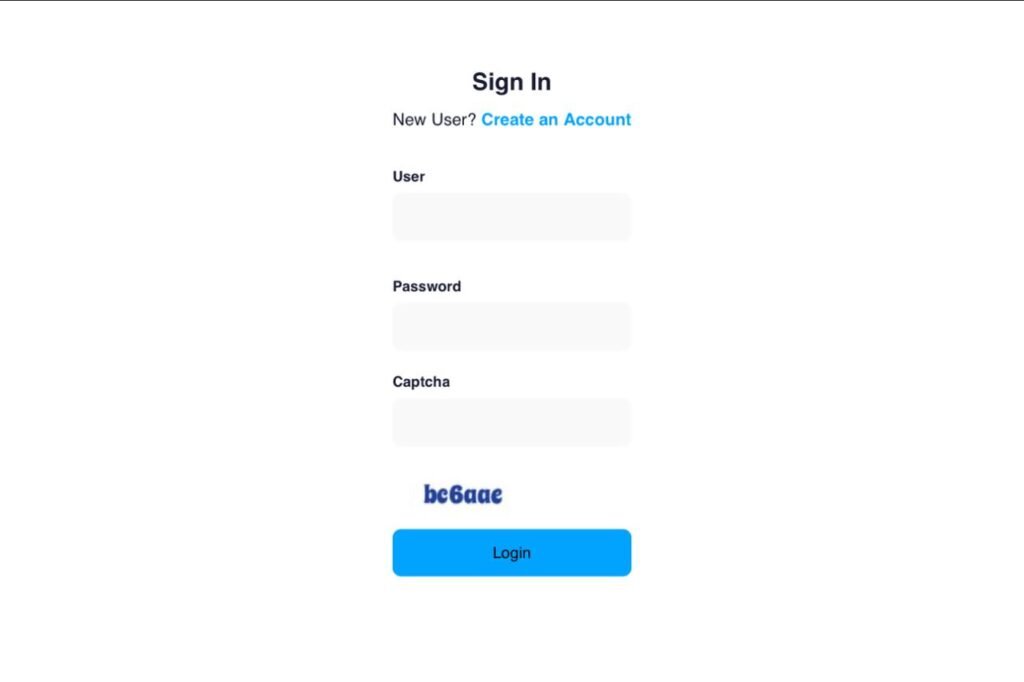

A Screenshot of Sharkshop (Sharkshop.biz) login page

Benefits of having a SharkShop credit card

Having a SharkShop credit card opens the door to numerous benefits tailored for students and young professionals. First off, many cards offer rewards programs that allow you to earn points on everyday purchases. This can lead to discounts or gift cards, making it easier to budget.

Additionally, SharkShop credit cards often come with low introductory interest rates. This means you can manage your spending without worrying about high fees piling up right away.

Another advantage is financial education resources provided by some issuers. These tools help build responsible financial habits early on.

Finally, the ability to establish a solid credit history cannot be overlooked. A good credit score sets the stage for future loans or mortgages when you’re ready for bigger investments in life.

Comparison of different SharkShop credit cards, including rewards, fees, and interest rates

When considering SharkShop credit cards, it’s crucial to compare their features. Each card offers unique rewards tailored for students and young professionals.

The SharkShop Rewards Card stands out with its generous cashback on everyday purchases. Earn 2% back on groceries and dining, making it a great choice for those managing tight budgets.

If travel is your passion, the SharkShop Travel Card may be ideal. It provides points for every dollar spent, which can be redeemed for flights or hotel stays. A modest annual fee applies but can easily be offset by the travel benefits.

For those wary of high interest rates, the SharkShop Student Card offers an introductory 0% APR period. This feature allows users to build their credit without worrying about accruing interest during the first year.

Understanding these differences helps in selecting a card that aligns best with individual financial goals and lifestyles.

Tips for responsible credit card usage

Managing a SharkShop credit card responsibly is essential for maintaining good financial health. Start by setting a monthly budget. This helps you track your expenses and ensures that you don’t overspend.

Always pay your balance in full when possible. Carrying a balance can lead to high interest charges, which can quickly add up.

Keep an eye on your spending habits. Use mobile apps or budgeting tools to monitor where your money goes each month.

Limit the number of cards you apply for at once. Too many applications can hurt your credit score and make it harder to manage payments.

Finally, take advantage of alerts offered by your bank. Notifications about due dates or spending limits can keep you informed and help avoid unexpected fees.

How to apply for a SharkShop credit card

Applying for a SharkShop login credit card is straightforward. Start by visiting their official website to explore the options available.

Once you’ve chosen a card that suits your needs, click on the “Apply Now” button. You will need to fill out an online application form with personal details like your name, address, and Social Security number.

Be prepared to provide financial information as well. This includes your income and any existing debts. Don’t rush through this part; accuracy matters.

After submission, you’ll usually get a quick response regarding approval status. If you’re approved, pay attention to the terms outlined in your agreement before using it for purchases.

Lastly, keep an eye on any activation steps required once you receive your physical card in the mail. It’s all about setting yourself up for success right from the start!

Real-life examples of how students and young professionals have utilized their SharkShop credit cards

Jessica, a college senior, found her SharkShop credit card invaluable during her study abroad trip. The rewards she earned on travel expenses helped fund excursions around Europe. Each purchase brought her closer to experiences she’d always dreamed of.

On the flip side, Mark, an entry-level graphic designer, used his card for everyday purchases like groceries and commuting costs. He maximized cash back offers that easily turned into savings for a new laptop essential for his work projects.

Meanwhile, Sarah utilized hers to build credit while managing student loans. With responsible payments each month, she improved her credit score significantly before applying for a car loan.

These stories reflect how SharkShop cards can adapt to varying financial needs and aspirations among students and young professionals alike. Whether it’s funding adventures or laying groundwork for future investments, the flexibility is appealing.

Alternatives to SharkShop credit cards

If SharkShop cc credit cards aren’t quite what you’re looking for, there are plenty of alternatives to explore. Many banks offer student-friendly options with low fees and manageable interest rates.

Consider a secured credit card if you’re just starting your credit journey. These require a cash deposit that acts as your spending limit. They can help build your credit while keeping risks low.

Another option is local credit unions, which often provide competitive rates and personalized service. Their offerings may include rewards programs tailored for students or young professionals.

Cashback apps also stand out as an alternative. While not traditional cards, they allow you to earn money back on purchases without the complexities of credit management.

Finally, consider store-specific loyalty cards. They often come with discounts and special offers that can be beneficial if you’re a frequent shopper at those retailers.

Conclusion: Is a SharkShop credit card the right choice for you?

When considering a SharkShop.biz credit card, it’s essential to assess your personal financial situation and needs. For students and young professionals looking for ways to build their credit history while enjoying rewards, the right SharkShop card can be a valuable tool.

Evaluate the various options available—each card comes with its unique perks, fees, and interest rates that may suit different lifestyles. If you often shop at places that offer enhanced rewards through these cards or need flexibility in managing expenses during college or early career stages, a SharkShop credit card could indeed be beneficial.

It’s also crucial to adopt responsible usage habits regardless of which option you choose. This means being mindful of your spending limits, paying off balances on time, and understanding how each transaction impacts your credit score.

As we navigate our financial journeys, knowing whether a SharkShop credit card aligns with our goals is vital before making any commitments. Consider what you’ve learned about yourself as an individual consumer: are you ready for the responsibilities that come with having this type of credit?