Whether you’re a freelancer, a small business owner, or someone who just wants to get a better understanding of their finances, having a paycheck stub can be an important part of managing your income. Paycheck stubs show a detailed breakdown of your earnings, deductions, taxes, and other contributions, and they are often needed for various purposes like loan applications, rental agreements, and tax filing.

For many people, especially small business owners and independent contractors, using a free paycheck creator or a free paycheck stub creator can be a simple and cost-effective way to generate these stubs without needing to hire an accountant or invest in expensive payroll software.

In this blog, we’ll explore everything you need to know about using a free paycheck creator. We’ll cover how it works, the benefits, and limitations, and how to use it effectively to create paycheck stubs that are both accurate and legally compliant.

What is a Free Paycheck Creator?

A free paycheck creator is an online tool or software that allows users to generate paycheck stubs at no cost. These tools are designed to help individuals or business owners create pay stubs quickly and easily, with all the necessary information included.

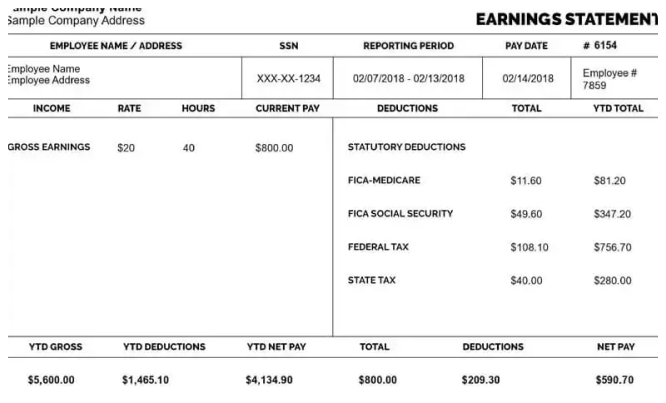

Typically, a paycheck stub will show the following:

- Employee Information: The name, address, and identification number (if applicable).

- Employer Information: The name and address of the employer or business.

- Gross Income: Total earnings before deductions.

- Deductions: Taxes, insurance, retirement contributions, and other withholdings.

- Net Income: The amount the employee takes home after deductions.

- Pay Period: The start and end dates of the work period.

With a free paycheck creator, you can enter all of this information manually into pre-designed templates or fields, and the tool will generate the paycheck stub for you.

How Does a Free Paycheck Stub Creator Work?

A free paycheck stub creator works by asking you to input the necessary details about the employee’s pay, taxes, and deductions. Some tools will have preset fields and drop-down menus to make the process even easier, and they often provide step-by-step guidance to ensure accuracy.

Here’s a basic rundown of how it typically works:

- Enter Employee Details: You’ll need to input basic information about the employee, including their name, address, and the pay period for which the paycheck is being created.

- Input Salary or Wages: Enter the employee’s salary or hourly wage, along with the number of hours worked or other pay methods (commission, bonuses, etc.).

- Specify Deductions: You’ll enter any deductions such as federal and state taxes, Social Security, Medicare, retirement contributions, health insurance premiums, and other withholdings.

- Generate the Pay Stub: Once you’ve input all the necessary information, the paycheck stub creator will generate a professional-looking pay stub that includes all the details—earnings, deductions, and net income.

- Download or Print the Pay Stub: After the stub is generated, you can download and print it or save it for your records.

Who Can Benefit from Using a Free Paycheck Stub Creator?

Several groups of people can benefit from using a free paycheck stub creator:

1. Freelancers and Independent Contractors

Freelancers and independent contractors often don’t have traditional pay stubs since they are self-employed or work with multiple clients. However, a paycheck stub can be a useful tool when they need to provide proof of income. For example, if a freelancer is applying for a loan or renting an apartment, landlords or financial institutions may require proof of consistent income. By using a free paycheck stub creator, freelancers can generate pay stubs that show their earnings for a particular period, making it easier to document their income.

2. Small Business Owners and Employers

If you’re a small business owner with a few employees, using a free paycheck stub creator can save you both time and money. Instead of investing in expensive payroll software, you can create pay stubs for your employees quickly and easily. This is especially useful if you don’t have a dedicated payroll department but still want to keep your records accurate and professional.

3. People Who Need Pay Stubs for Personal Use

Some individuals might just need a pay stub for personal reasons, such as tax filing, income verification, or personal budgeting. Using a free paycheck stub creator is a great way to generate this type of document without having to pay for expensive software or services.

Benefits of Using a Free Paycheck Stub Creator

There are several advantages to using a free paycheck stub creator:

1. Cost-Effective

One of the most obvious benefits is that it’s free. Traditional payroll software can be expensive, especially for small businesses or independent workers. With a free paycheck stub creator, you can create professional pay stubs without spending a dime.

2. Time-Saving

Creating paycheck stubs manually can take time, especially if you don’t have access to the right tools. Free paycheck stub creators simplify the process by providing ready-to-use templates, pre-filled fields, and easy-to-follow steps. This can save you valuable time and ensure accuracy.

3. User-Friendly

Most free paycheck stub creators are designed with simplicity in mind. They often have user-friendly interfaces with clear instructions, so you don’t need any special expertise to use them. Even someone with little to no experience in payroll or accounting can create a paycheck stub easily.

4. Accurate and Professional

A well-designed paycheck stub helps make your earnings appear more legitimate and professional. By using an online paycheck creator, you can ensure that all the necessary details are included and formatted correctly, which is especially important when you need to provide a pay stub for loans, rentals, or other official uses.

5. Customizable

Many free paycheck stub creators allow for customization, so you can add or remove fields as necessary. For example, if you have specific deductions that don’t appear in a standard template, you can easily include them. Customization allows you to tailor the paycheck stub to your unique needs.

Limitations of Free Paycheck Stub Creators

While free paycheck stub creators offer many benefits, there are some limitations to keep in mind:

1. Limited Features

Some free paycheck stub creators may have limitations in terms of customization, the number of stubs you can generate, or the types of deductions they can handle. If you need more advanced features or a high level of customization, you may need to consider upgrading to a paid version.

2. Lack of Integration

Free tools often don’t integrate with accounting or payroll systems, which means you may need to manually input data each time you create a new pay stub. Paid versions, on the other hand, may offer integration with other tools, saving you even more time.

3. No Legal Compliance Guarantees

While free paycheck stub creators can generate pay stubs, they don’t always guarantee compliance with local, state, or federal laws. For example, the tool may not be updated with the latest tax rates or changes in employment law. It’s essential to double-check that the generated pay stub reflects the current rules and regulations in your state.

4. Basic Design

Free paycheck stub creators may offer limited design options. While the stubs will still contain the necessary information, the design may be more basic and less polished than what you’d get from paid software.

How to Use a Free Paycheck Stub Creator Effectively

To ensure you’re using a free paycheck stub creator correctly, follow these tips:

- Double-check all Information: Always review the entered details carefully before generating the paycheck stub. Accuracy is key, especially when dealing with taxes and deductions.

- Use Reliable Tools: While there are many free paycheck stub creators available, not all of them are trustworthy or accurate. Stick to reputable sites or platforms with good reviews and a history of delivering quality results.

- Save or Print the Stubs: Once you’ve generated the pay stubs, save them in a secure location (such as your computer or cloud storage) and keep physical copies for your records, if needed.

- Stay Updated on Tax Laws: Tax rates and payroll rules can change, so make sure the paycheck stub creator you’re using stays updated with any new tax regulations or legal changes.

Conclusion

A free paycheck creator or free paycheck stub creator can be a valuable tool for anyone who needs to generate pay stubs quickly and easily. Whether you’re a freelancer, a small business owner, or just someone looking to verify your income, these tools offer an affordable and convenient way to create professional pay stubs.

Just remember that while these tools can be incredibly helpful, they may have limitations and won’t always guarantee compliance with the latest laws. Always double-check your numbers, stay updated on tax regulations, and make sure you’re using a reliable tool to ensure accuracy.

Related Articles

How to Access Kroger Paystubs Anytime, Anywhere

Complete Guide to Dollar General Paystubs(DG Paystub) and DGME Portal

How to Use the Walmart Paystub Portal Easily?

Employee Guide: Accessing ADP Pay Stubs with Ease

How To Get a Pay Stub From Ford?

How to Access, Download, and Interpret Dollar Tree Pay Stubs