Tax season can be one of the most stressful times of the year for small business owners, freelancers, and gig workers. With deadlines looming and piles of paperwork to manage, it’s easy to feel overwhelmed. But what if there was a simple way to reduce some of that stress and ensure your tax filings are accurate and timely? Enter the free paycheck maker — A powerful tool that can make the payroll and tax process a whole lot easier.

In this blog, we’ll explore how using a free paycheck creator can simplify your payroll management, reduce errors, and ultimately help make tax time less stressful. Whether you’re a small business owner with a handful of employees or a freelancer juggling multiple clients, these tools can help you stay organized and tax-ready year-round.

What Is a Free Paycheck Creator?

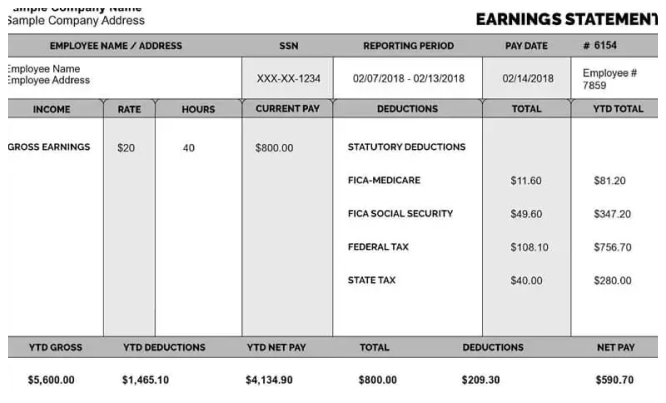

A free paycheck creator is an online tool that allows you to generate paychecks and pay stubs quickly and accurately. By entering basic information like employee names, pay rates, hours worked, and tax withholdings, the free paycheck maker calculates gross pay, deductions, and net pay, and then generates a pay stub. These pay stubs can be shared with employees or kept for your own records.

The primary appeal of a free paycheck creator is that it’s accessible, easy to use, and doesn’t come with the hefty price tag associated with some premium payroll software. Many free paycheck makers are perfect for small businesses, freelancers, and gig workers who don’t need the more advanced features offered by expensive payroll tools but still want a quick and reliable way to handle payroll.

Now, let’s dive into how using a free paycheck creator can help you tackle the stress of tax season.

1. Accurate Tax Calculations

One of the most stressful aspects of tax season is ensuring that all your payroll taxes are calculated correctly. Tax laws in the U.S. are complicated and change frequently, and making a mistake can lead to penalties, fines, and a headache when it comes time to file your taxes.

Using a free paycheck creator can help eliminate this worry. These tools often come with built-in tax calculators that can automatically calculate federal, state, and local tax withholdings based on the most up-to-date tax rates. This is particularly helpful for small businesses that don’t have the resources to hire an accountant or use expensive software.

For example, a free paycheck maker will:

- Automatically calculate Social Security and Medicare taxes.

- Determine federal and state income tax withholdings based on the employee’s filing status and exemptions.

- Handle additional deductions like retirement contributions, healthcare premiums, and other benefits.

How this helps during tax season:

By using a free paycheck creator to ensure that all payroll taxes are calculated correctly throughout the year, you can rest easy knowing that when tax season arrives, you’ll have accurate records for filing. This minimizes the chance of errors and makes it easier to complete tax filings, reducing your stress.

2. Organized Record-Keeping

During tax time, one of the most important tasks is having clear and organized records. The IRS requires employers to keep accurate payroll records, including wages, tax withholdings, and deductions. Without proper documentation, you could face fines or delays in filing your taxes.

With a free paycheck maker, you can easily keep all your pay stubs and payroll records organized in one place. Most paycheck creators store historical pay stubs, making it easy to reference past payments and track the total wages and taxes paid throughout the year.

For example, if you use a free paycheck creator to generate pay stubs for your employees each pay period, the tool will store the details of each transaction. This way, when tax season rolls around, you can easily access the necessary pay stubs and reports to ensure your records are in order.

How this helps during tax season:

Having all your payroll records neatly organized and easily accessible makes filing your taxes much more efficient. You won’t have to spend time searching for missing pay stubs or trying to recall how much you paid your employees in the past year. You’ll have everything you need at your fingertips, reducing the time and stress involved in tax filing.

3. Simplified Tax Forms and Filings

For business owners, freelancers, and contractors, one of the most stressful tasks during tax season is ensuring that all the correct tax forms are filed on time. Whether you’re filing as a sole proprietor, partnership, LLC, or corporation, there are numerous forms you need to complete, including 1099s, W-2s, and payroll tax forms like the 941.

While free paycheck creators won’t file taxes for you, many of them can help generate the necessary forms you need for your tax filings. For example, they may allow you to generate W-2 forms for your employees or 1099 forms for independent contractors. Some tools will even calculate year-to-date totals for wages, taxes, and deductions, making it easy to fill out your tax forms accurately.

A free paycheck maker will:

- Automatically summarize the total wages paid to employees.

- Provide you with the data needed to complete W-2 and 1099 forms.

- Help you keep track of tax payments and deductions for each employee.

How this helps during tax season:

Having access to ready-to-use tax forms and reports means you can easily submit your filings to the IRS and state tax authorities without scrambling to gather information. This reduces the complexity of tax filing and ensures you meet all deadlines without mistakes.

4. Time-Saving Automation

One of the biggest sources of stress during tax time is scrambling to complete everything in a short period. When you’re managing a business, you already have a full plate—scheduling appointments, answering emails, fulfilling orders, and more. The last thing you need is to spend hours calculating payroll and ensuring tax accuracy.

A free paycheck creator saves you valuable time by automating many of the steps involved in payroll. Instead of manually calculating hours worked, wages, tax deductions, and benefits, the tool does the heavy lifting for you. With just a few pieces of information, you can generate pay stubs quickly, allowing you to focus on other aspects of your business.

For example, instead of calculating your employee’s hourly rate, hours worked, and taxes manually, you can input the relevant data into the free paycheck maker, and the tool will generate the pay stub automatically.

How this helps during tax season:

The more time you save throughout the year with accurate payroll, the less work you’ll have to do when it’s time to file your taxes. When tax season comes around, you won’t need to scramble to track down earnings or calculate tax withholdings manually. You’ll have everything ready, thanks to the time-saving automation of a free paycheck creator.

5. Less Chance for Payroll Errors

Human errors are a common cause of tax issues. Whether it’s miscalculating an employee’s hours, forgetting to apply a tax rate, or making a mistake with deductions, payroll errors can lead to underpayment, overpayment, or incorrect tax filings. These mistakes can result in penalties and fines and cause a significant amount of stress during tax season.

A free paycheck maker reduces the likelihood of such mistakes by automating payroll calculations. The software typically uses updated tax tables and deduction guidelines, ensuring that calculations are correct every time. Additionally, most free paycheck creators are designed with user-friendly interfaces that minimize the chance of entering incorrect information.

How this helps during tax season:

By using a free paycheck creator to handle payroll year-round, you can significantly reduce the chance of errors that could complicate your tax filings. When the time comes to file taxes, you’ll have accurate records that make the process smoother and more stress-free.

6. Helps With Independent Contractors

If you’re a freelancer or small business owner who works with independent contractors, managing payroll can become even more complicated. Unlike employees who receive W-2 forms, contractors receive 1099 forms, which require different calculations and reporting.

A free paycheck creator often supports the generation of 1099 forms, allowing you to keep track of payments made to contractors throughout the year. By keeping these records organized, you can easily generate the necessary tax forms when it’s time to file.

How this helps during tax season:

By using a free paycheck maker for your contractors, you won’t have to worry about scrambling to gather their payment details when tax season arrives. You’ll already have the information you need, making it easier to file 1099s and comply with IRS requirements.

Conclusion

Tax time doesn’t have to be a stressful experience. By using a free paycheck creator, you can streamline your payroll processes, reduce the risk of errors, and stay organized year-round. Whether you’re a freelancer, small business owner, or gig worker, these tools can help you maintain accurate records, automate payroll calculations, and ensure that tax forms are completed on time.

With the help of a free paycheck maker, you’ll find that tax season becomes much more manageable. You’ll save time, reduce the risk of errors, and have everything you need at your fingertips when it’s time to file. So, if you’re looking for a way to make tax time less stressful, a free paycheck creator might just be the solution you’ve been searching for.

Related Articles

How to Access Kroger Paystubs Anytime, Anywhere

Complete Guide to Dollar General Paystubs(DG Paystub) and DGME Portal

How to Use the Walmart Paystub Portal Easily?

Employee Guide: Accessing ADP Pay Stubs with Ease

How To Get a Pay Stub From Ford?

How to Access, Download, and Interpret Dollar Tree Pay Stubs