For many small business owners, freelancers, and gig workers, the task of handling payroll can be overwhelming. Ensuring that employees are paid accurately, on time, and in compliance with tax laws can take a significant amount of time and effort. But one often-overlooked tool that can help simplify payroll and make tax filing much easier is a check stub maker. By automating the process of generating real check stubs, a check stub maker can help both employers and employees streamline their financial record-keeping and ensure smoother tax filing come April 15.

In this blog, we’ll explore how a check stub maker works, the key benefits it offers in terms of tax preparation, and how it can help save time, reduce errors, and increase accuracy during tax season.

What Is a Check Stub Maker?

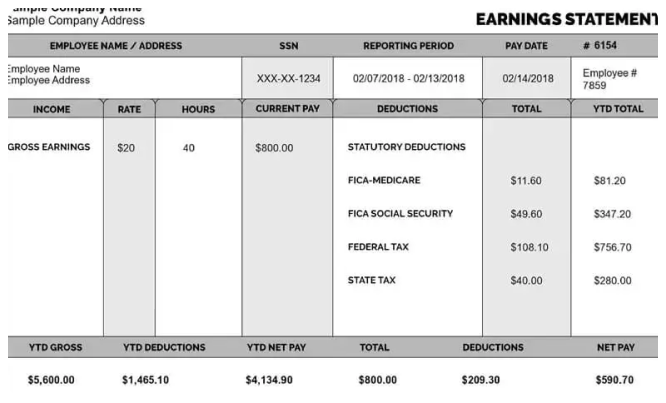

A check stub maker is an online tool or software that allows business owners, freelancers, or employers to generate professional pay stubs for employees or themselves. It takes the basic payroll information (such as wages, deductions, tax withholdings, and net pay) and organizes it into a clear, easy-to-read format that shows how much an individual earned in a particular pay period.

Check stubs typically include:

- Gross pay (the total earnings before any deductions)

- Deductions (for taxes, insurance, retirement plans, and other benefits)

- Net pay (the final take-home amount after deductions)

- Year-to-date (YTD) totals for earnings and taxes

The pay stub is crucial not only for the employee to understand their pay breakdown but also for tax purposes. Having an accurate real check stub at hand can make tax filing much smoother, both for individuals and for businesses.

How a Check Stub Maker Simplifies Tax Filings

While generating pay stubs is an essential part of managing payroll, they are also a key component when it comes to filing taxes. Here’s how a check stub maker can help simplify the tax filing process:

1. Ensuring Accurate Tax Withholdings

One of the most significant roles of a check stub maker is ensuring that tax withholdings are calculated correctly. Taxes can be complicated, and miscalculating how much to withhold can lead to serious consequences, including fines and penalties.

With a real check stub, tax withholdings such as federal, state, and local income tax, Social Security, and Medicare are clearly displayed, giving both employers and employees a snapshot of how much has been withheld for taxes in any given pay period. Most check stub makers are programmed to use up-to-date tax rates, ensuring that the proper amounts are deducted from each paycheck.

Additionally, a check stub maker will typically show year-to-date totals for each type of tax, which can be incredibly helpful when it’s time to file taxes. This eliminates the need to manually calculate deductions, reducing the chance of errors.

Benefit for Tax Filing:

At tax time, having accurate records of all tax withholdings makes it easier for business owners and employees to file their taxes accurately. For employees, the information on their pay stub can be directly transferred to their annual tax return. For employers, the clear breakdown of tax withholdings ensures that they meet their tax reporting obligations and avoid costly mistakes.

2. Clear Record-Keeping and Audit Preparation

Keeping track of earnings, deductions, and taxes is essential for small businesses, especially when it comes to tax filings. Check stub makers help create digital records of pay stubs that are much easier to store and access than paper copies. In the case of an IRS audit, having a well-organized and easily accessible record of employee wages and tax withholdings can make the entire process much less stressful.

Most check stub makers allow users to store pay stubs electronically, often in secure cloud storage. This means that if you need to access a pay stub from several months ago or gather records for a specific employee, you can do so quickly and easily. Having these records readily available ensures that you can provide the necessary documentation when filing taxes or if the IRS requests it.

Benefit for Tax Filing:

In case of an audit or tax review, having access to organized pay stub records can save time and prevent any discrepancies. During tax season, these records can help both employees and employers report their earnings and deductions accurately.

3. Year-to-date totals (YTD) for Easy Tax Preparation

Another key feature of a real check stub is the inclusion of year-to-date (YTD) totals. YTD totals provide a running tally of an employee’s earnings, taxes withheld, and other deductions throughout the year. These totals are incredibly important for tax preparation, as they give both employees and employers an overview of the financial activity to date.

For employees, YTD totals allow them to easily see how much they’ve earned and how much has been deducted for taxes, insurance, and other benefits. When filing taxes, employees can use their YTD totals to determine if they’ve had too much or too little tax withheld.

For business owners, YTD totals help ensure that you’ve withheld the correct amount of taxes over the year. If the totals are inaccurate, it could lead to underpayment or overpayment when it’s time to file.

Benefit for Tax Filing:

When tax season arrives, employees will need their YTD totals to file their income taxes, and business owners will need this information to fill out their payroll tax reports. A check stub maker that clearly displays YTD totals makes the process of tax filing much easier and ensures that both employees and employers have the accurate information they need.

4. Simplified Tax Deductions and Benefits

Many businesses offer various tax-deductible benefits to employees, such as health insurance, retirement plans (e.g., 401(k)s), and flexible spending accounts (FSAs). A check stub maker allows these deductions to be automatically calculated and reflected on the pay stub.

What does this mean for tax filings?

- Employees: When it’s time to file taxes, employees can use their real check stub to claim deductions for things like retirement contributions or health insurance premiums. The pay stub clearly outlines the deductions taken, making it easier for employees to report these on their tax returns.

- Employers: As a business owner, you are responsible for withholding the correct amount of employee contributions to benefits and ensuring these deductions are accurately reported to the IRS. A check stub maker that automatically calculates and tracks these deductions can help you meet your tax reporting obligations.

Benefit for Tax Filing:

By ensuring that tax-deductible benefits are properly calculated and reflected on pay stubs, both employees and employers are better equipped to handle tax deductions. Employees can use the pay stub to support their tax return, while employers can use the same information to ensure they are in compliance with tax laws and benefit regulations.

5. Easier End-of-Year Tax Reporting (W-2s and 1099s)

For employers, year-end tax reporting can be one of the most stressful aspects of running a business. If you’re an employer with employees, you need to provide them with W-2 forms by the end of January, which summarize their total wages and taxes withheld for the year. If you’re a contractor or freelancer with multiple clients, you may need to generate 1099 forms for income earned.

A check stub maker can simplify this process by automatically generating the necessary totals to create these forms. For instance, if your employee’s pay stubs show YTD earnings and tax deductions, those amounts can be directly transferred to a W-2 form. Similarly, if you’re a freelancer using a check stub maker to create pay stubs for your clients, the totals can be used to generate a 1099 form that reports your freelance income.

Benefit for Tax Filing:

By using a check stub maker to generate accurate pay stubs throughout the year, employers and freelancers alike can more easily produce the required forms (W-2 or 1099) come tax season. This reduces the risk of errors and ensures that employees and contractors are correctly reported to the IRS.

6. Easy Distribution for Employees

When tax time rolls around, employees often need to have access to their pay stubs to verify their earnings and deductions. A check stub maker typically allows employers to easily download or email pay stubs to employees, making it easy for them to access their tax information whenever they need it. This is particularly helpful when employees are filing their taxes, applying for loans, or managing personal finances.

Benefit for Tax Filing:

By providing employees with easy access to their pay stubs throughout the year, they can track their earnings and deductions, making tax filing much more straightforward. For employers, this ensures that all employees have the correct documentation for their own tax returns.

Conclusion

Using a check stub maker is more than just a way to generate pay stubs—it’s a valuable tool for simplifying the tax filing process for both employers and employees. By ensuring accurate tax withholdings, providing clear records of deductions, and making year-end tax reporting easier, a check stub maker helps both small business owners and their employees navigate the complexities of taxes with ease.

In addition to saving time and reducing errors, a real check stub generated by a reliable check stub maker provides peace of mind that the tax filing process will be much less stressful and much more accurate. Whether you’re a small business owner, freelancer, or gig worker, using a check stub maker can help you stay organized, compliant, and ready for tax season.

Related Articles

How to Access Your MyHTSpace Pay Stub?

How to Get a Check Stub From TruBridge?

How To Get Paystub From Zachary

Everything You Need to Know About Your Ford Paycheck Stubs

How to Obtain Hobby Lobby Pay Stubs: A Detailed Guide

The Importance of Tracking Your Family Dollar Paystub for Tax Season